Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Trading methods: trend following

Trend following is applicable to all time horizons; from day trading to swing and position trading as well as investing. It is, however, particularly successful on longer-term time frames. The basic idea is to profit from the continuation of an existing move by trading in the direction of the trend.

Trend following refers to both rising and falling markets. On time frames such as daytrading as well as swing and position trading stops are used for risk management of a position. Usually, there is no profit target in order to give a trade the opportunity to fully develop its potential. Instead, the stop will often be trailed to secure book profits step by step.

The process is different for long-term investing. Here the strategy ultimately corresponds to a trend following buy-and-hold strategy for just uptrends. Due to the time frame investors will usually not use profit targets nor stops for their positions. That approach is useful only for investments in the broad stock market which is expected to rise in the long term as it has been historically.

Now what is the reason trend-following is a useful strategy? The answer is that time and again, there are trends in the markets on all time frames which can be exploited with this method. However, it is anything but easy. Actually, it can be quite difficult to take action on all signals of a trend-following approach due to market phases in which price goes sideways and whipsaws create losses over and again. Unfortunately, no one can anticipate when these phases begin and end. Therefore, the key is to be patient and to take each signal even (and especially) when stuck in a drawdown within a series of losses.

Most trend following traders are using technical analysis. Based on simple tools such as moving averages or series of higher/lower highs and lows it is possible to quickly determine the predominant trend on the chart. Especially in short-term trading technical tools are essential to most traders.

Two ways to enter the market

- Break-out: entry as price breaks out to a new high/low and potentially indicates the start of a new trend

- Pullback: entry as price makes a (first) pullback after a strong initial move

Advantages and disadvantages

Both entry systems have specific advantages and disadvantages. The break-out trader is involved from the very moment the breakout occurs and profits in case of fast continuation moves which often prove to cause the strongest trends. The downside is, however, that the breakout might prove to be a false signal and price falls back into its range. Or even worse, it attempts a break-out on the opposite side of the range and causes a stopout and loss.

Pullback traders can reduce that risk. Here we wait to see if the break-out is at all successful. Only then the trader buys into a pullback and profits in case of a continuation move in the direction of the trend. The risk of getting stopped out is significantly lower as the break-out has proven itself already. However, this approach has a catch, as well. In case price breaks out rapidly and no pullback occurs for a while, the trader misses the whole opportunity to trade that signal.

Break-out versus Pullback entry for trends

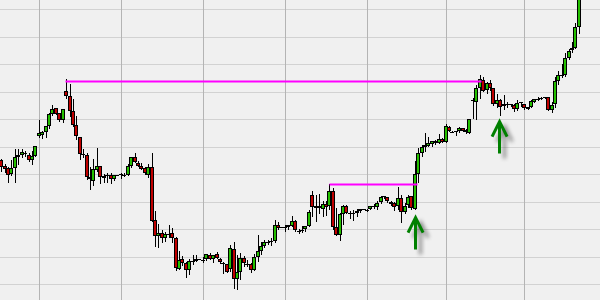

The 60-minute chart of the DAX shows two breakouts, first on a shorter horizon (see 1st arrow) and then on a longer horizon (2nd arrow). The first break-out occurred without any pullback; therefore, only direct buyers of the move were able to profit. For the second trade, however, pullback traders had lots of time to adjust their setup and get a lower entry price within the pullback before the trend continued.

Download a free real-time demo of the NanoTrader Full trading platform used in this article