Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

The MAD Rebound trading strategy

Who said moving averages are no good? This strategy proofs the reverse. MAD Rebound is one of the more than 50 free trading strategies in NanoTrader. This strategy appears to give consistently good results over time. It has several original features, not in the least the MAD_Exit instead of a traditional stop. The MAD_Exit tends to avoid unnecessary stop outs and tends to reduce the size of a loss as compared to a traditional stop.

The MAD Rebound trading strategy offers many advantages:

- It can generate a good return without using leverage.

- It does not use a traditional stop, thus avoiding unnecessary stop outs.

- It does not use a traditional stop, thus reducing the size of losses.

- It can be traded manually, semi-automatically and automatically.

- It is particularly suitable for markets moving up and down sideways in a range!

- It has a high proportion of winning trades, thus limiting mental stress on the trader.

- It is FREE.

The strategy is less suitable for markets which move strongly in a clear sustained direction. Early morning trades should be avoided either due to price gaps skewing the averages or due to the strong directional movement.

1. WHAT CAN BE TRADED?

| a) Suitable for: | |

| Market indices (Dow, S&P500...), Forex (EUR/USD...), crude oil... | |

| b) Instruments: | |

| Futures, CFD, forex. | |

| c) Trading type: | |

| Scalping and day trading. | |

| d) Trading tempo: | |

| Many signals every day. | |

| e) Using NanoTrader Full: | |

| Manual or (semi-)automated trading. |

2. THE STRATEGY IN DETAIL

The MAD Rebound strategy is traded in a 5-minute time frame.

The first component of the MAD Rebound strategy is the MAD Filter. The MAD Filter colours the background of the chart green if buy signals are acceptable and red if short sell signals are acceptable.

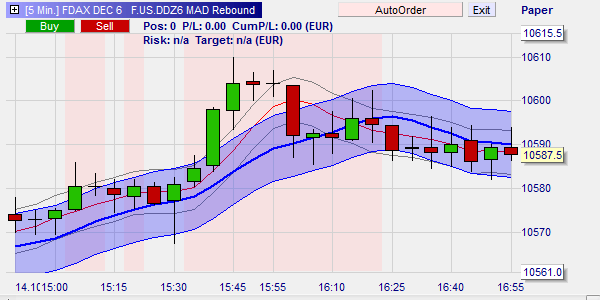

This example shows the MAD Filter. The green background indicates buy signals are acceptable. The red background indicates short sell signals are acceptable. When the chart background is white, no signals will be accepted.

The second component is the MAD Signal. The MAD Signal is the blue line and corresponding bands. The third strategy component is the MAD Exit. The MAD Exit partially manages the open position. It consists of a red line and corresponding grey bands.

This example shows the MAD Signal line and its bands (blue) and the MAD Exit line and its bands (red).

3. WHEN TO OPEN A POSITION

A long position is bought when the chart background is green and when the market price closes a precise number of ticks below the average market price.

A short sell position is sold when the chart background is red and when the market price closes a precise number of ticks above the average market price.

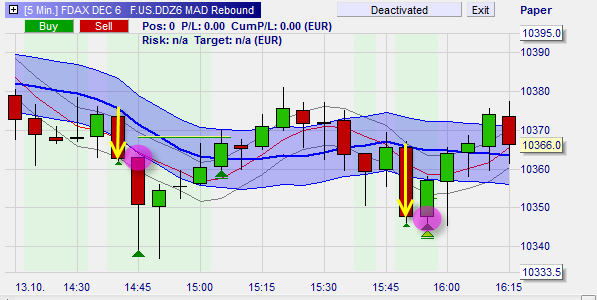

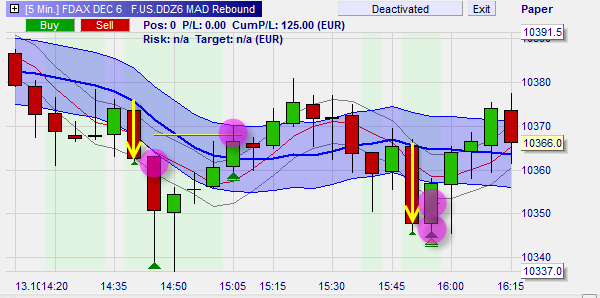

This example shows two buy signals on the DAX future. The MAD Filter colours the chart background green and the market closes 15 ticks below the average market price (blue MAD Signal line). A position is bought at the open of the next candle.

This example shows two short sell signals on the DAX future. The MAD Filter colours the chart background red and the market closes 15 ticks above the average market price (blue MAD Signal line). A short sell position is sold at the open of the next candle.

Download a free real-time demo of the NanoTrader Full trading platform

4. WHEN TO CLOSE A POSITION?

The MAD Rebound strategy uses a profit target and a stop. The profit target is small. The stop is far removed from the market price and serves as a safety net. The stop is not often triggered.

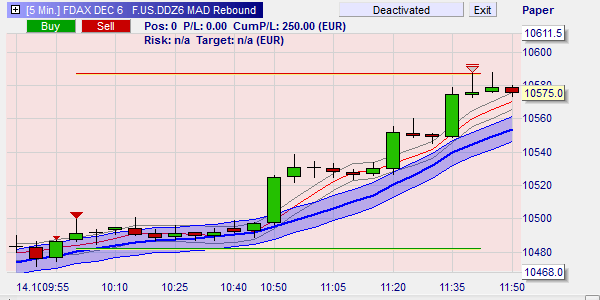

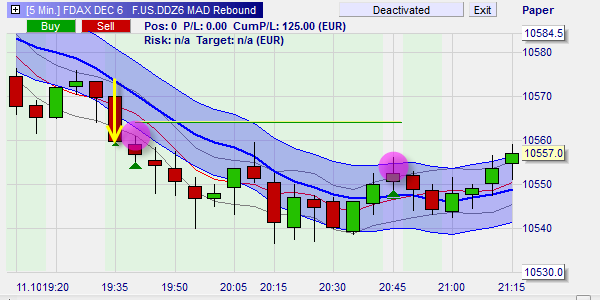

This example shows a short sell position which was closed by the stop.

A small profit target is, per definition, frequently reached. A trading strategy with a very high proportion of winning trades is encouraging and mentally bearable for many traders. The risk of such a strategy is that once in a while the profit target is not reached and one loss may wipe out a good portion of the profits built up over time. This is where the unique MAD Exit comes.

The philosophy of a traditional stop loss and the MAD Exit is very different. A stop loss closes the position when a maximum acceptable loss occurs. The MAD Exit is more subtle. It is based on the principle that when a market moves against the trader, it will, in most cases, not do so in a straight line but by going up and down. The MAD Exit will close the position when the market temporarily moves back in the right direction. This may allow the trader to reduce the loss.

The absence of a traditional stop loss close to the entry price can also give the position the possibility to lose some ground before reaching the target.

The MAD Exit is the red line with the grey bands. When the market closes a precise number of ticks above (below) the red line the position is closed.

See below for a table containing the precise number of ticks for the major markets.

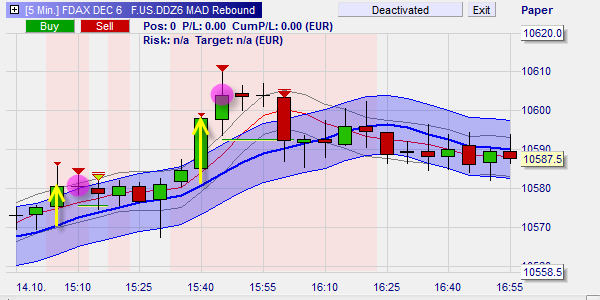

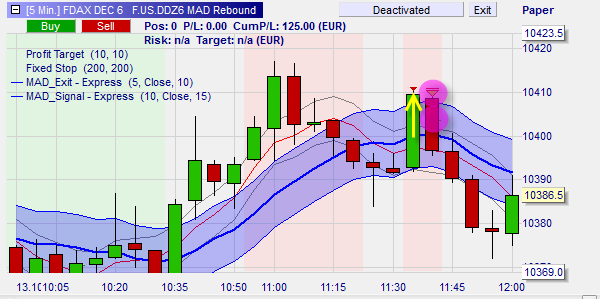

This example shows two buy signals on the DAX future. In both cases the profit target (green line) is reached. The second trade is the most typical, with the profit target being reached in the same candle.

This example shows a short sell signal. Typically the small profit target is reached quickly. The accumulation of many small profitable trades is typical for the MAD rebound strategy.

This example shows the MAD Exit at work. A buy signal occurred. The market went down and the profit target was not reached. A traditional stop would have closed the position when the market was going down. The MAD Exit, however, closed the position later; when the market was moving up again and closed 10 ticks above the red MAD Exit line. This reduced the size of the loss.

A second advantage of using the MAD Exit instead of a traditional stop loss is that the absence of a stop gives the position time to be weak but to ultimately still reach the profit target.

This example shows a long position after a buy signal. The position takes over an hour to reach the profit target. If the trader would have used a traditional stop the position would have been closed in the beginning when the market was going down.

Finally, the MAD Rebound strategy also contains a time filter. If the TradeGuard is activated, the time filter will close the position automatically at 21h45.

5. CONCLUSION

De MAD Rebound strategy trades small rebounds. When the market drops or climbs sharply in a short space of time, often a rebound (reverse movement) will occur. Typical for a strategy with small profit targets, the percentage of winning trades is high. Mentally this suits many traders. To avoid a big loss wiping out whole or part of the profits built up over time, the strategy partially relies on the unique MAD Exit. Attention should also be paid to the slippage as it can reduce the size of an already small potential profit.

Interestingly the MAD Rebound trading strategy is at its best when the market is moving more or less sideways in a range. A trading strategy which performs well in a range is very rare. For this reason traders should do the effort to familiarize themselves with the MAD Rebound strategy.

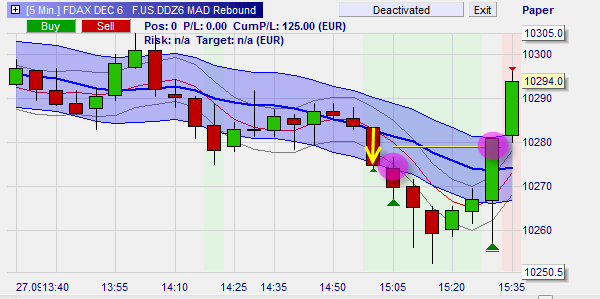

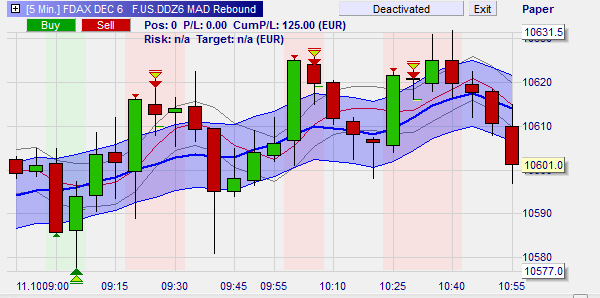

This example shows the DAX in a range of only 40 points (0,3%). The strategy opens four positions. All positions are closed with a profit.

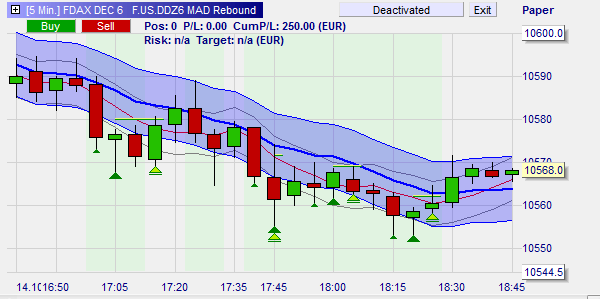

This example shows the DAX in a range of only 30 points (0,28%). The strategy opens four positions. All positions are closed with a profit.

Investment Trends broker analysis:

"WH SelfInvest is clearly the leader in overall client satisfaction. We have never seen such high quality scores.", states Irene Guiamatsia, Research Director, Investment Trends.