Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

See the future

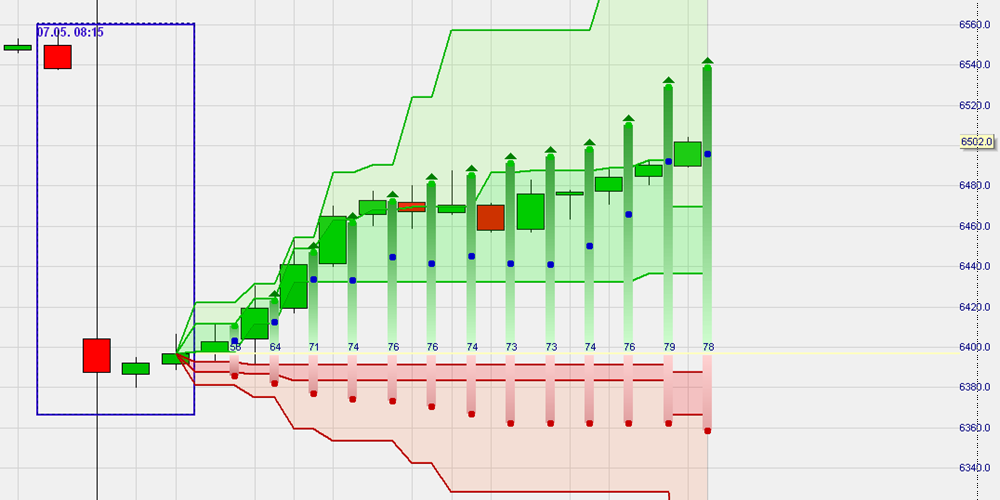

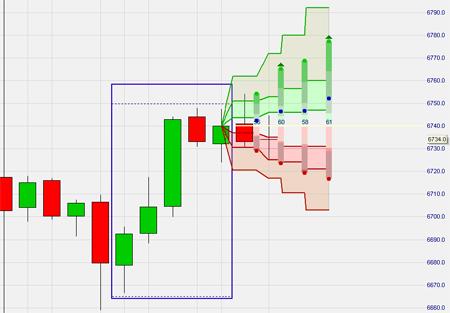

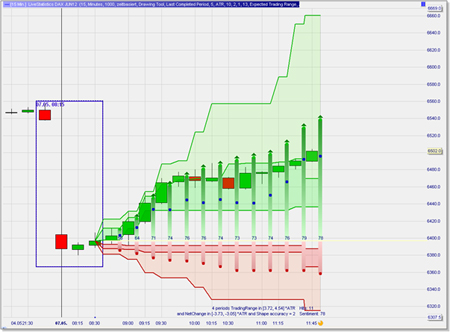

LiveStatistics allows investors to define an event based on different parameters. LiveStatistics will identify in real-time how often similar events occurred in the past. All these past events are analyzed in real-time. Based on the price developments of the past events, projections for the current market price are displayed in the chart.

- The user defines an event based on a set of parameters (shape, trading range …).

- LiveStatistics identifies all similar events in the past.

- LiveStatistics displays projections for the current market price in the chart.

Download a free real-time demo of the NanoTrader Full trading platform

1. WHAT HAPPENED IN THE PAST?

- Buy because it is a strong, consistent rally which is simply taking a pause.

- Don’t buy because this rally has run out of steam and the market was very negative after the opening.

- A "reality check". The projections are a good indication of how the market price can move over a given period of time. Many investors have price expectations which are not realistic.

- Determining stops and price targets. These levels are visible in the chart.

- Confirming a signal given by a strategy. If, for example, a strategy gives a buy signal, the live statistical data should show a bullish sentiment.

- Trading strategies based on live statistical data.

€uro am Sonntag broker test:

„The lowest price broker. The best order execution.“

The respected finance magazine "€uro am Sonntag" tested 13 CFD-Forex broker on 733 criteria. In this wide-ranging test of the brokerage industry broker WH SELFINVEST came in first, once more.

Try a few trading strategies... download a real-time NanoTrader Full demo.