Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Creative with stop orders

The NanoTrader platform allows the trader to place stop orders in other units besides the market price. Other units in which stop orders can be placed are percent and ATR.

1. THE TRADITIONAL STOP ORDER

The traditional stop order is based on the market price. Buy at 100. Put a stop at 95. If the market drops to 95 the position is sold at the market price.

The NanoTrader platform allows the trader to place stop orders in other units besides the market price. Other units in which stop orders can be placed are percent and ATR.

2. A STOP IN PERCENT

Instead of using a fixed value for his stop, say, 5 points, the trader can also enter a percentage. When entering a percentage the NanoTrader platform will automatically place the stop order on the entry price minus the percentage.

Assume the trader decides on 1%. When the trader buys at 4.000 the stop order will be placed 1% percent below the entry, at 3.960.

More on stop orders:

- The unique periods high-low stop.

- Multiple stop orders on the same position.

- Placing a stop on your trend lines.

3. A STOP BASED ON VOLATILITY (average true range)

Every financial instrument has a volatility. The volatility is not constant. The higher the volatility the broader the normal range in which the instrument’s price will evolve. Traders need to take the current volatility of an instrument into account to avoid being stopped out unnecessarily when volatility increases.

Volatility is measured by the average true range (ATR). An increase in range means in increase in volatility and vice versa. By instructing the NanoTrader to automatically place the stop level at a fraction or a multiple of the ATR the trader automatically adapts to changes in an instrument’s volatility.

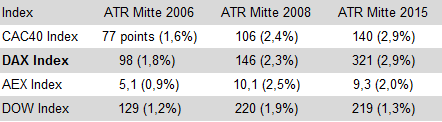

This table illustrates the evolution of volatility over a number of years on different market indices. It is clear that the trader who uses the same stop in 2015 as he did in 2006 will be stopped out much more frequently.

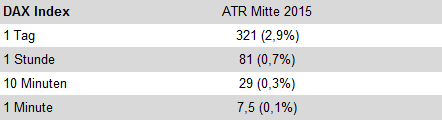

This table illustrates that the average true range is also relevant to daytraders. Daytraders must adapt their stop level to the time frame in which they trade. Smaller time frames, smaller stops and vice versa.

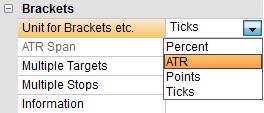

The unit in which the NanoTrader must place the stop order is selected in the DesignerBar.

Download a free real-time demo of the NanoTrader Full trading platform

4. TRADING VIDEOS

Besides the possibility to change the units of stop orders, the NanoTrader also offers many different stop order types.

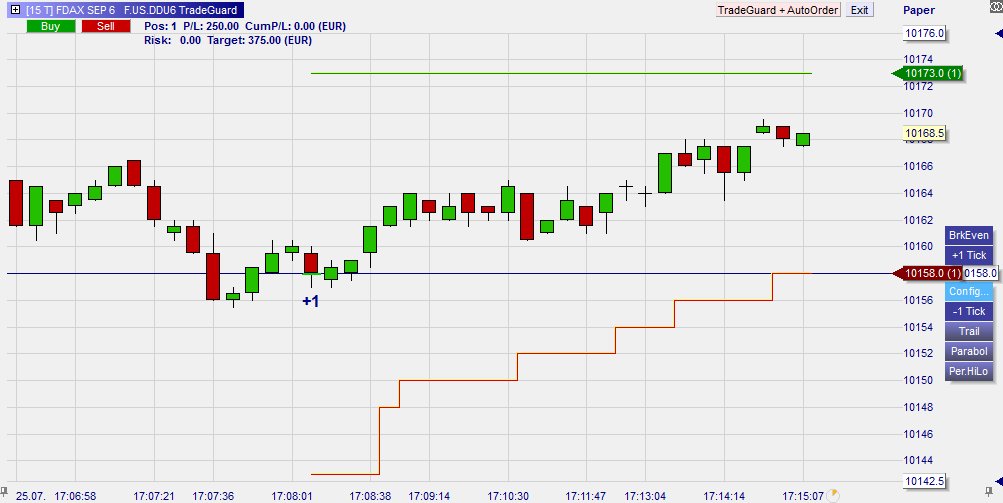

This video shows some of the stop order types available in the NanoTrader:

Download a free real-time demo

The experiences of some traders with broker WH SelfInvest...

NanoTrader is my fourth trading platform and it is by far the best. – H.B.

It is incredible what your trading platform can do. – N.R.

NanoTrader is a reliable and robust trading platform. – C.U.

The NanoTrader leaves no desire unmet. – W.G.

Download free e-books on trading in the library.

Improve your trading... test the incredible NanoTrader trading platform.