Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

How to create a Black Candles strategy on the Dow?

With the return of volatility on the stock markets, one may wonder what approach to apply to day trade the Dow Jones index? The solution we propose is to work with the Mini Dow Future on which we apply a trading-strategy made up of two studies: study 1 assumes the role of trend filter while study 2 contains the Black Candles signal. This article describes how to build such a strategy from scratch in NanoTrader, our multi-award winning trading platform.

1. Mini Dow Future

The Mini Dow Future is one of the most popular futures contracts on the CME (Chicago Mercantile Exchange) among retail investors. It is indexed to the Dow Jones Industrial Average, which includes 30 of the largest U.S. multinational companies. The Mini Dow Future has a value of $5 per point and a nominal value of $175,000 when the Dow is at 35,000 points. The daytime margin is $1,680.

2. Build a trend filter

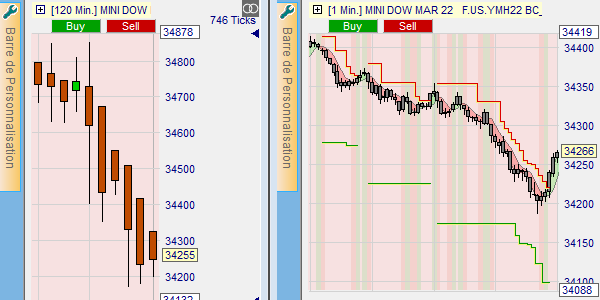

A trend filter is a very important part of a trading strategy. Its purpose is to indicate the direction of the trend. There are several trend filters and some are more effective than others. In study 1, we select the Heikin Ashi indicator and load it into a 120-minute candlestick chart. We can see below that the coloring of the background is consistent with the direction of the trend: green when rising and red when falling. This crucial information for filtering signals will be exported in study 2.

3. Combine the two studies to form the strategy

Study 2 consists of a 1-minute candlestick chart in which we enter 4 elements: the signal, stop and target of the Black Candles strategy as well as the trend information imported from Study 1. In the layout below, Study 1 is on the left and Study 2 is on the right. We can see that there were 3 winning short signals and that the trailing stop was particularly effective in securing profits.

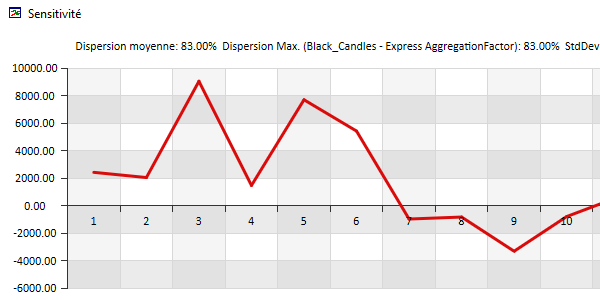

4. Search for the right setting

At this point, we have a complete strategy. However, when we evaluate its effectiveness over a period of 100 days, the cumulative results are negative. The challenge is to find a setting that gives a positive result. To do this, we proceed in two steps. Step 1 is to reduce the trading period to the range 3pm-6pm CET. Step 2 is to find the best setting for the AggregationFactor parameter. Sensitive analysis of this parameter reveals that the value 3 produces the highest profit.

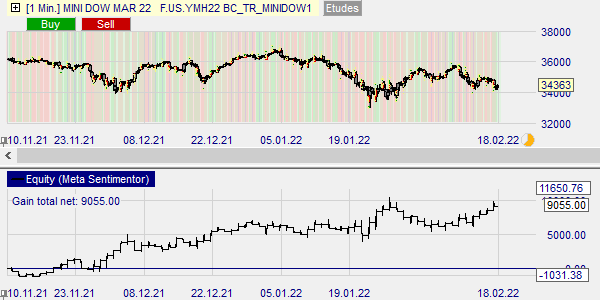

Sensitive analysis is a remarkable feature of the NanoTrader platform that allows you to find profitable settings in seconds. The back-test of the Black Candles strategy with the latest settings shows a spectacular performance.

Conclusions

This article has shown you how to build an effective day trading strategy in a few steps. The essential elements of this strategy are the signals, stops and targets of the Black Candles strategy as well as the trend import technique. However, these elements alone are not enough to produce a profitable strategy. You have to work hard to find profitable settings. The NanoTrader multi-award winning trading platform and its sensitive analysis feature are essential to finding profitable setups quickly. The approach we have described in this article can be repeated at any time to find a new strategy or adapt an existing one. This strategy applies to all financial instruments offered by WH SelfInvest: stocks, futures and CFDs.