Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Multiple targets and stops

The NanoTrader is without equal when it comes to handling multiple stops and targets.

- There is no limit on the number of stops and targets that can be combined.

- The intelligence managing the stops and targets is remarkable. Even if you make a mistake it is very difficult to shoot yourself in the foot.

- Setting up multiple stops and targets is easy.

- A set-up can be saved as a study for future use.

- Multiple stops and targets can be set and managed from the chart.

- Once orders are placed, they can always be changed to another price level by sliding them in the chart.

Multiple stops and targets are only available in the NanoTrader Full. They are handled by the TradeGuard function and can be used in CFD, forex and futures trading.

In this example the trader has a 5 targets (sell limit orders) and 1 stop (sell stop order). As the next step, either the stop could be hit and all 5 target orders will be cancelled automatically or the first target could be reached and the order size of the stop will be automatically reduced from 5 to 4 lots.

Tip: every NanoTrader user has a permanent demo account. If you have not yet worked with multiple stops and targets you can first try your ideas on your demo account.

1. SETTING UP MULTIPLE STOPS AND TARGETS

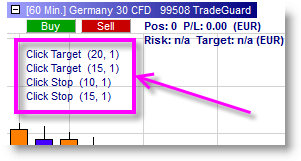

Multiple stops and targets can be set up via the Designer window or via the chart. Click the “Add indicator” icon and add as many click stops and click targets as you need. They will appear in the Designer window and in the chart like so:

To parameter the stops and targets you can go via the Designer window or left-click on the numbers in brackets in the chart. With the mouse-wheel you can change the values. The first number is the distance of the stop or the target. The distance can be set in different units (points, ticks ...). Setting the unit is done in the Designer window. The second number is the distribution ratio of the lots per order. Right click on the stop or the target to remove it.

Tip: if you buy more (or less) lots than the number you indicated the TradeGuard can still handle the distribution. It will always follow a logic of the least risk possible. If, for example, the trader above buys 3 lots, the TradeGuard will put 2 lots on the closest target and the closest stop (instead of 1) and 2 on the other target and stop. If the trader buys 4 lots, TradeGuard can respect the ratio again and will allocate 2 lots to each of the 2 stops and the 2 targets.

2. ACTIVATING MULTIPLE STOPS AND TARGETS

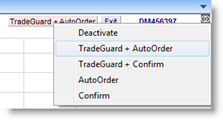

Like any other (semi-)automated instruction in the NanoTrader platform, multiple stops and targets will only be placed automatically when you open your position if you activated the TradeGuard in the chart:

Tip: if you forgot to activate the TradeGuard before opening your position, you can still activate it after your position is open. Keep in mind, however, that certain stop types such as the trailing stop will base themselves on the market price at that point in time.

3. A PRACTICAL EXAMPLE

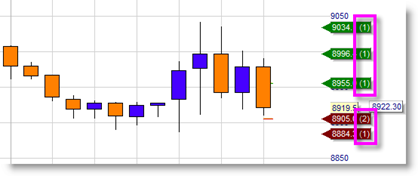

In this example the trader has a position of 3 lots. He has 3 targets and 2 stops. The closest stop is for 2 lots and the remaining stop for 1 lot.

The stop was hit and 2 lots were sold. The TradeGuard cancelled the two closest target orders. The trader is now long 1 and is protected by the remaining stop and target.

Tip: you can grab the triangle of the order label with your mouse and slide the order to another price level if necessary.

4. A TRADING STRATEGY USING MULTIPLE TARGETS AND STOPS

The T-Line Scalping strategy is available for free in the NanoTrader platform (open it via the WHS Strategies folder). The strategy has multiple targets (2 or 4) and a single stop.

Interestingly the strategy uses the average true range (ATR) to calculate the distances of the targets and the stop. The ATR is a measure of the volatility. If an instrument is volatile, the targets and the stop will be placed further from the market price. If an instrument’s volatility decreases the targets and the stop will be placed closer to the market price. This is done automatically by the NanoTrader.

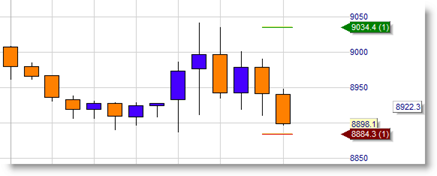

In this example the trader opened a short position of -4 Mini-DAX futures. He will have 4 different targets and a single stop. In the illustration below the first target has already been reached, 3 targets remain and the platform has automatically reduced the quantity of the stop order to 3 lots.

When the second target is reached, 2 targets remain and the platform automatically reduces the quantity of the stop order to 2 lots.

In T-Line Scalping, after the second target has been reached, traders will often slide the stop order to their entry price. Now the trader can no longer lose.

The market turns and moves up. The stop is reached and the position is closed. The two remaining targets are cancelled automatically.

5. TRADING VIDEOS

This video shows multiple stops and targets:

This video shows a trader's position after some of his targets have been reached:

Deutsches Kundeninstitut (German Clients Institute) broker comparison:

"It gives me great pleasure to inform you that WH SelfInvest scores 5 out of 5 stars with the BEST possible mention , "extremely good" (1,3). This makes you de best CFD-Broker for 2018. Congratulations!"

These are the scores of WH SelfInvest in the sub-categories:

- Order execution: 5 out of 5 stars. Mention: very good (1,2).

- Trading platform: 5 out of 5 stars. Mention: very good (1,1).

- Mobile trading: 5 out of 5 stars. Mention: very good (1,1).

- Customer service: 5 out of 5 stars. Mention: very good (1,4).

Test a free real-time Demo of the NanoTrader Full trading platform.