Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Reject trading signals

Time filters allow traders to accept or reject trading signals depending on when they appear. By adding one or more time filters the trader can manage his signals AND position based on time. The possibilities are endless. For example reject signals during the opening phase of a trading session, the five minutes before and after important statistics are announced and during a deadzone such as lunch time.

These are the advantages of time filters:

- Choice of time filters with different functions (flat, bloc).

- Filters types can be combined.

- Filters can be easily switched on/off.

- No programming required.

Download a free real-time demo of the NanoTrader Full trading platform

1. A PRACTICAL EXAMPLE

Let’s look at a simple example which is not uncommon. A trader may want...

- To not open any new position 20 minutes before the market close, and

- to close any remaining open positions 5 minutes before the market close, thereby avoiding overnight positions.

These requirements can be automatically managed by the NanoTrader. They require no coding or programming. In the example the trader would use a block filter and a flat filter.

2. FLAT FILTERS AND BLOCK FILTERS

These two types of time filters each have their own logic.

Flat ensures that an open position is closed and that new entry signals are ignored.

Block ensures that open positions remain open until an exit signal occurs, but entry signals are ignored.

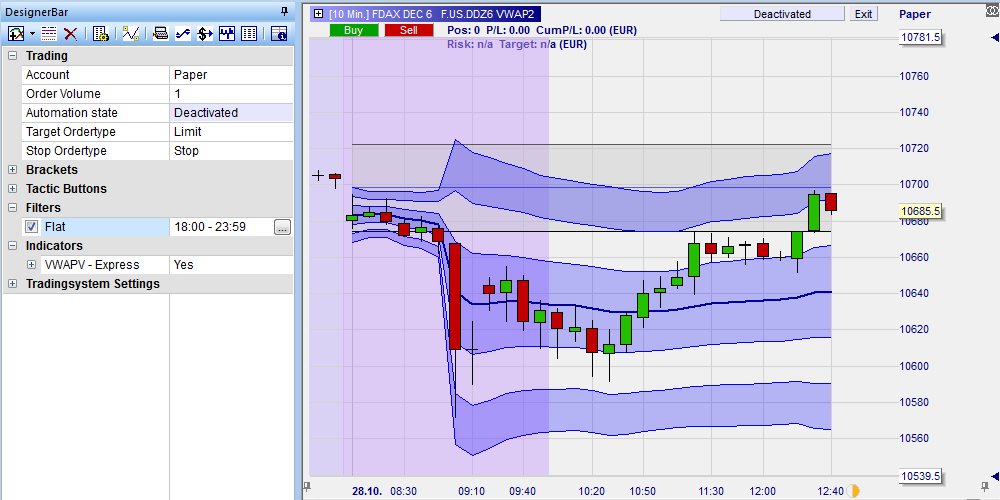

Block and flat periods are visible in the charts.

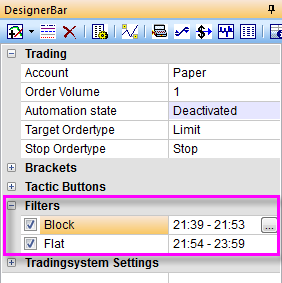

This example shows the filter settings for the trader who does not want to open any new positions 20 minutes before the market close and who wants to close any open position 5 minutes before the market close.

The time filters can be activated or deactivated by simply (un)ticking them.

Investment Trends broker analysis:

"WH SelfInvest is clearly the leader in overall client satisfaction. We have never seen such high quality scores.", states Irene Guiamatsia, Research Director, Investment Trends.