Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Range Break-out trading signals

This signal detects the periods where the market is in a horizontal trading range. Once a range has been detected, the signal will indicate when the market breaks out of the range.

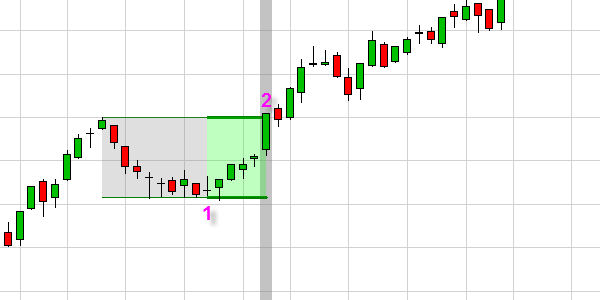

The example illustrates how the signal works:

A horizontal trading range is detected at candle 1. The grey zone represents the range. The green (red) edges indicate that this range comes after a bullish (bearish) trend. Between candles 1 and 2 the borders are green and large and the range is colored in light green. As long as the market doesn't break out of the range the green zone will continue. At candle 2 the market closes outside the range. This is a buy signal as indicated by the grey background in the chart.

THE WAY YOU WANT IT

Basically all parameters can be decided by the trader.

The trader can opt to only receive signals in the direction of the trend, to only receive signals against the trend or to receive all break-out signals whatever the trend. He can set the start time and the end time.

Besides a visual reference in the chart the trader can opt to receive notifications via e-mail, sound and a pop-window.

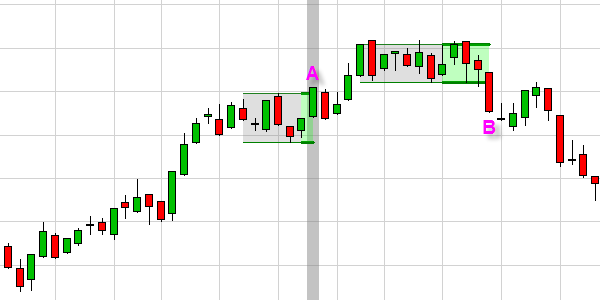

This example show a trader who opted to receive only signals in the direction of the trend. The green trading ranges indicates that in both cases the range occured after a positive trend. The first break-out (A) is in the direction of the trend. This triggers a trading signal. The second range break-out (B) is against the direction of the trend. Hence no trading signal is triggered.

The Range Break-out trading signal is:

- free

- requires no programming

- can be traded manually and (semi-)automatically

- can, for example, be combined with automated stop orders, target orders ...

Download a free real-time demo of the NanoTrader Full trading platform