Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

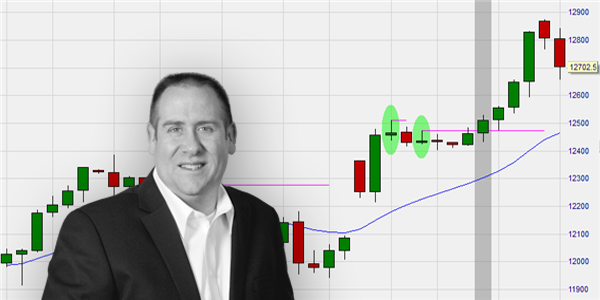

BBT Trader Rob Hoffman

Rob Hoffman has won numerous real money competitions as a trader. He is also known as an educator (Become a Better Trader, BBT) and mentor for proprietary traders and portfolio and hedge fund managers.

Related to Rob Hoffman and available free of charge in the NanoTrader (free demo) trading platform:

1. Trading strategies, signals and tools

The Inventory Retracement Bar

2. SignalRadar (more...)

–

Trader Rob Hoffman

The Inventory Retracement Bar (IRB)

One approach developed by Rob is the IRB. The idea here is to identify activity by institutional traders that temporarily runs counter to the current prevailing trend and take advantage of it. Specifically, the idea is to identify when the counter-trend movement dries up and the institutional traders are highly likely to trade in the overriding direction again.

First, the overriding trend direction must be determined. A simple approach to this is to analyse the slope of the exponential moving average over 20 days (EMA 20), which should clearly be rising (for an upward trend) or falling (for a downward trend) in the period under consideration. In addition, the trend at the next higher time level should point in the same direction. This is important because false signals are more likely to occur in higher-level sideways phases.

The open and close of a candle must be at least 45 percent below the high to be an IRB candle. When the market is in a positive trend and an IRB has been identified, it is time to ... wait. An entry signal only occurs when the market rises above the high of the IRB. The concept is reversed when the market is in a negative trend.

This example of a daily chart shows three IRBs and a positive trend. In the first case, the market does not rise above the high of the IRB. No signal occurs. The second IRB is replaced by the third IRB before a signal occurs. The third IRB generates a buy signal four days later. A signal is indicated by the grey background in the chart.

Managing open positions

Open positions should be hedged with a stop. According to Rob Hoffman, this is placed just above or below the opposite end of the IRB. In addition, a trailing stop is recommended, with which 50 per cent of the realized profit is hedged in the event of success. If the price approaches an important support or resistance, 90 per cent should be hedged or the trade should be closed directly with a profit target.

Detailed article

Article about this award-winning strategy

People also read

- Rob Hoffman's Inventory Retracement trades

- Trading based on the Parabolic SAR indicator

- Scalping trading ranges with the new SNIPER