Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Creative trader John F. Carter

Trader and fund manager John F. Carter is the author of the book "Mastering the trade". He describes techniques for trading intraday setups. Some of John F. Carter's strategies have been included in NanoTrader.

Related to John F. Carter and available free of charge in the NanoTrader (free demo) trading platform:

1. Trading strategies, signals and tools

The 21:52 strategy

The LOHP strategy

The HOLP strategy

2. SignalRadar (more...)

–

Trader John F. Carter

The 21:52 trading strategy

The 21:52 strategy was developed by trader and author John F. Carter in his book "Mastering the trade". This day trading strategy focuses on the market action in the last 45 minutes of trading in the US markets.

21:30 is generally known as the key time in late trading. The strategy is applied to the two largest American stock market indices (Dow Jones and S&P 500). This happens at exactly 21:52 CET. It is a simple trading strategy, which tries to profit from irrational trading behaviour after 21:30.

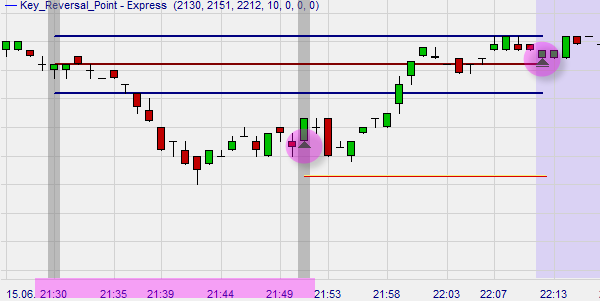

This example of the S&P 500 shows a buy signal.

The HOLP (buy) strategy and the LOHP (short sell) strategy

LOHP

LOHP stands for "Low of the High Period". A difficult name for a simple strategy. These are the criteria for a short sell signal:

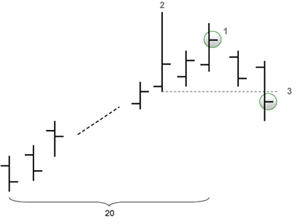

1. Find the highest closing price over the last 20 periods.

2. Identify the bar with the highest high of the last 20 periods.

3. Identify the low of this bar. Open a short position at the first closing price below this low.

John F. Carter applies this strategy to all instruments. He usually trades it on the basis of a daily chart. Nevertheless, the strategy can be used in all time frames, including smaller time frames such as 60' or 30' minutes for intraday trading.

The LOHP strategy only uses a stop loss to protect the position. It does not use a profit target.

1. The stop is set at the high of the bar that formed the highest high of the 20 periods.

2. If the position is still open two periods later, the stop is tightened to the high of the penultimate bar.

HOLP

HOLP stands for "High of the Low Period". It is simply the mirror strategy of the LOHP strategy.

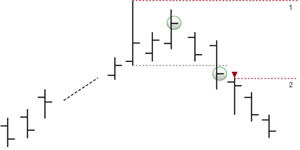

The following examples show the good results that can be achieved with these strategies when the right strategy is used in the right market trend!

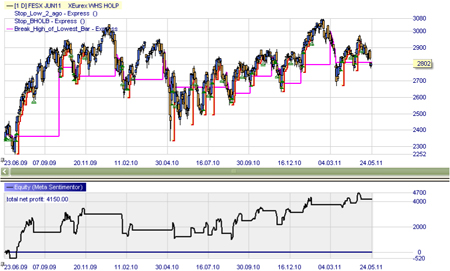

This example shows the HOLP buy strategy opening long positions in a bull market. The result is good.

This example shows the LOHP strategy short selling in the same bull market as above. The result is obviously not good.

An expert tests the strategies

On of our experts tested these two strategies. These are the conclusions:

"John F. Carter's HOLP strategy works best if the trader succeeds in using it 'at the right moment'. Timing is one of the major difficulties in trading. It is not evident to identify with precision when a trend starts and when it ends or when a trend correction occurs. Carter unfortunately leaves this to the trader to figure out. Perhaps a trader who follows different markets simultaneously with these two strategies can identify in which market the opportunities are best at a particular point in time. In combination with the analogous LOHP strategy for bear markets, a profitable overall strategy could perhaps be worked out. But it would need a lot of testing and experimenting."

"For beginners, Carter's strategies are therefore probably not optimal."

Recommended broker

People also read

- Trader-Author Larry Williams

- The sensational Volume Viewer for futures

- John F. Carter: How to trade momentum after calm market phases