Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Larry Connors, trader & entrepreneur

Larry Connors has over 34 years of direct experience in the financial markets industry and is widely regarded as one of the leading professionals in the field. He is the principal managing partner of Connors Global Asset Management LLC. Larry Connors is the author of more than 20 books on market strategy and volatility trading, including How Markets Really Work.

Related to Larry Connors and available free of charge in the NanoTrader (free demo) trading platform:

1. Trading strategies and signals

The RSI 2P strategy

The Momentum Pinball strategy (with Linda Raschke)

The R3 strategy

2. SignalRadar (more...)

Yes

Trader Larry Connors

The RSI 2P trading strategy

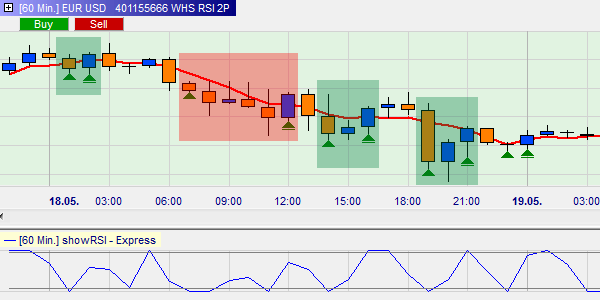

The 2-period RSI strategy is based on the idea of a return to an average price. In the case of overbought or oversold markets, the strategy expects the market price to revert to an average. The strategy goes short when the trend is negative (bearish) and the market is overbought. The strategy buys when the trend is positive (bearish) and the market is oversold. The strategy is easy to apply to all financial instruments in day trading.

To determine whether the market is in a positive or negative trend, we use a 200-period moving average (MA). To identify overbought and oversold situations, Connors uses the 2-period RSI. In short, signals are generated by the 2-period RSI and filtered by the 200-period MA.

This example shows several trades using the RSI 2P strategy: three winners, one loser and one break-even trade.

For day trading purposes, the strategy can be used on a 30 or 60 minute basis. Connors also uses the strategy in swing trading (positions lasting several days). In this case, he opens the positions earlier, just before the market closes, instead of at the opening price of the next day.

The opinion of a trading expert

"Larry Connors' RSI 2P seems to us a robust strategy that performs particularly well on FX pairs. We can imagine this strategy very well as a stabilising factor in an overall portfolio of several strategies. The signals are easy to understand. We can therefore happily recommend the RSI 2P strategy to novice day traders."

Interview with Larry Connors

In this review we briefly summarise the most interesting points from an interview with Larry Connors (interviewer Marko Gränitz):

- The Relative Strength Index (RSI) by Welles Wilder is a very useful concept. From Larry Connors' point of view, the RSI in the two-period setting is even the best single indicator in trading.

- In screenings for good stock setups, it makes sense to leave out penny stocks and other highly volatile, unpredictable stocks. In addition, the stocks to be traded should have sufficiently high liquidity and correspondingly narrow bid-ask spreads.

- In the event of a significant sell-off compared to yesterday's closing price, after which the price hardly recovers until the end of the trading day, further losses are to be expected on the following day. If there is then another strong intraday sell-off, this often represents an exaggeration if the movement is accompanied by panic selling.

- Systematic trading strategies without stops are usually more successful. Backtests clearly show that, on average, the further a stock has fallen, the more likely it is to form a trend reversal. Many positions where the stop would be reached therefore still turn a profit later. These lost profits weigh more heavily than the few large losses.

- Traders can alternatively work with in-the-money options. Here the risk is limited to the premium paid, so there is an "automatic" stop loss.

- Instead of opening a position directly in full size, one can use scaling. For example, a position is opened in steps of 20, 30 and 50 per cent. Alternatively, four steps of 10, 20, 30 and 40 percent are conceivable. This is particularly suitable for ETFs, as there is almost always a pullback sooner or later. With shares, on the other hand, scaling can be risky, since one is in with the full position size if the price continues to fall and the pullback fails to materialise.

- Backtests are a crucial basis for success. The testing period should extend over many years. The interaction between the hit rate and the average profits and losses of a trading strategy must be taken into account.

- The analysis of fundamental key figures plays no role in short-term trading.

If you are looking for a good managed account, check out this service...