Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Andrews pitchfork, drawing the pitchfork correctly

Most traders are familiar with the Andrews Pitchfork drawing tool. The distinctive pitchfork shape definitely attracts the eye. In spite of being very recognisable few traders can draw Andrews pitchfork correctly. This article suggests one solution to draw a usable Andrews Pitchfork.

THREE POINTS

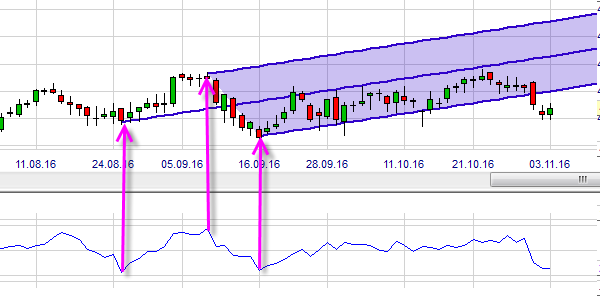

The trader drawing Andrews Pitchfork needs to determine three points. By adding the RSI technical indicator below the chart, it can be used to determine the three points. Select the three most extreme last high and low points of the RSI. The combination to draw needs to be either low-high-low or high-low-high.

This example shows the combination low-high-low taken from the RSI indicator below the chart. This results in an Andrews Pitchfork with a slightly bullish trend.

TIP: EXTEND THE FUTURE

In trading the Andrews Pitchfork is used in various ways. All evolve around the concepts of the market price moving within the band, returning to the central line or breaking out. In all cases it is useful for the trader to see his Andrews Pitchfork well extended into the future. This also allows him to see where support and resistance levels based on the chart, intersect with the Andrews Pitchfork.

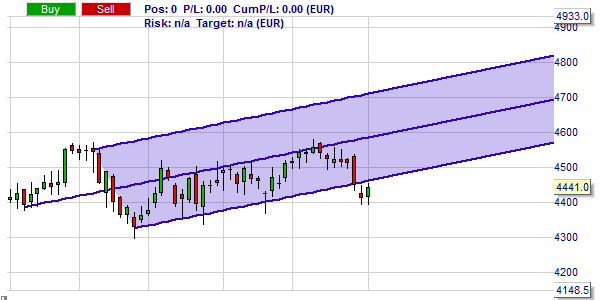

The NanoTrader allows you to set the percentage of your chart which is dedicated to the future. This is extremely useful for traders working with drawing tools.

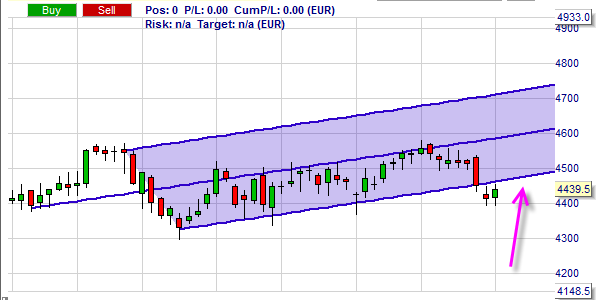

This example shows a trader with 10% of his chart dedicated to the future. This is typical for most trading platforms and cannot be changed usually. For a drawing tool like Andrews Pitchfork which extends into the future, this is not optimal.

This example shows a trader which set 33% as the part of his chart dedicated to the future. Suddenly the visibility improves.

Download a free real-time demo of the NanoTrader Full trading platform