Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Daytrading strategy US stocks

Strategies for daytrading and scalping all major US stocks are quite rare. The NanoTrader trading platform contains such a strategy. The exciting WL Vola Open strategy combines the best functionalities of the NanoTrader (automatic trading, multiple targets...) with the experience of a top trader, Belgian Wim Lievens.

These are the advantages of the WL Vola Open strategy:

- Well suited for day trading and scalping.

- Smart, ingenious and yet easy to use.

- Designed by a very experienced trader.

- Trading action immediately after the market opens.

- Perfect for automatic trading.

- No hassle... Pre-configured charts for the 50 most volatile US stocks.

Test a free real-time demo of the NanoTrader trading platform.

THE WL VOLA OPEN STRATEGY

The WL Vola Open strategy is based on two observations:

- Market volatility is highest in the first two hours after market opening.

- After the market open there is often a strong price movement.

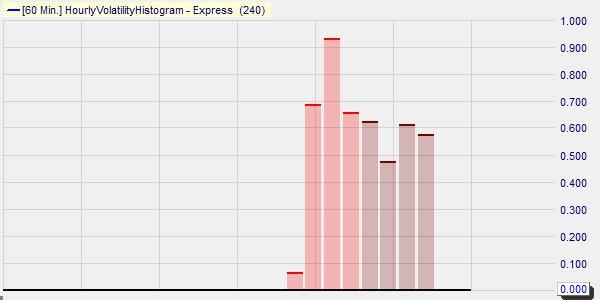

This example shows a volatility histogram of Apple. The market opens at 15:30. The Apple share is clearly most volatile in the first two hours (15:00-16:00 and 16:00-17:00) after market open.

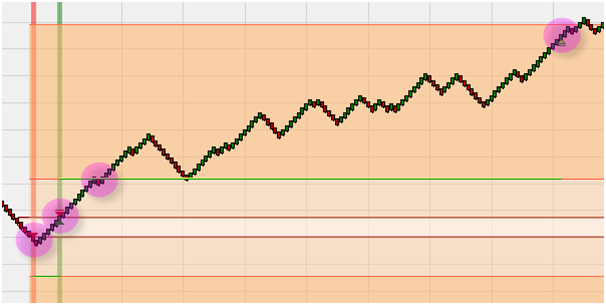

To determine the opening range, the proprietary WL Range Bars - exclusivelin the NanoTrader - are calculated. The WL Range Bars combine the advantages of Heikin Ashi candles, traditional range bars and Renko bars. In addition to the opening range, the strategy immediately calculates two additional trading ranges. These price ranges are used as profit targets.

A vertical green line in the chart background indicates a buy signal. A vertical red line in the chart background indicates a short sell signal.

This example first shows a short sell signal. The short sell position is converted into a long position when the stop is hit. The long position is a success and reaches both the first and the second profit target.

RISK MANAGEMENT

The WL Vola Open strategy uses one stop loss and two winning targets. When the trader activates the TradeGuard, NanoTrader automatically places the two profit target orders; 1/3 of the position on the first profit target and 2/3 of the position on the second profit target.

The stop level is located at the lower (upper) end of the opening area. After reaching the first profit target, NanoTrader places the stop on the entry price (a break-even stop in Trader jargon). The trader has a small profit and can no longer lose it. The pressure is off the kettle. The remaining 2/3 of the position is covered with the unique Triad Stop. This unique stop is also automatically placed and managed by the NanoTrader.

The WL Vola Open strategy also includes an entry and an exit filter. The exit filter closes all remaining open positions on US stocks at 9:45 pm.

This strategy pack for Nanotrader available in the store includes:

- The WL Vola Open Trading Strategy.

- The WL Bars.

- The WL Triad Stop Loss.

- Preconfigured analyses for the 50 most volatile stocks.

- Preconfigured analyses for the 4 market indices.

- One hour online coaching by Wim Lievens.

- Two hours of video coaching in French, German or Dutch.

- Unlimited telephone access to the support desk.

- A reduction of the minimum order fee for CFDs on US stocks from $7 to $4 (-43%)!

TRADING CFDs ON STOCKS

Stock trading doesn't have to be expensive. Thanks to CFDs (Contracts for Difference) any private investor can trade stocks without having to have a large amount of capital. The investor is required to only put up part of the total value of his open position.

These are the advantages of trading equity CFDs:

- CFDs are transparant financial instruments. They trade at the same price as the underlying stock.

- As a rule, only 10% of the current value of the total position is required to open the position.

- The commissions are lower than trading regular stocks.

- The investor must not pay the market for real-time quotes.

- Greater diversification and choice than with indices or forex.

- Stocks tend to be more volatile than indices or forex.

It is clear that most traders trade indices (DAX, Dow Jones) or currencies (EUR/USD). This of course means that the competition among traders in these markets is much greater than in the other markets. A trader who knows how to select the stocks that are currently in demand through a targeted selection has a better chance of making a profit than if he only trades the index. If he is right in his assessment, it is quite possible to achieve profits of 3-5% per trade, which is rarely the case with indices.

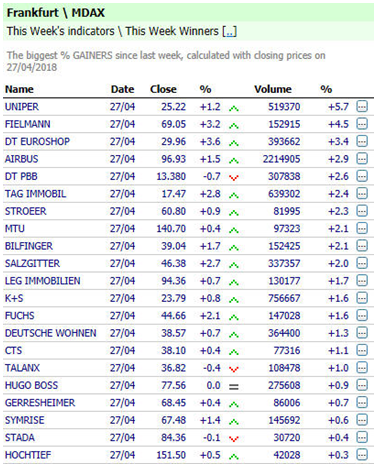

The TechScan tool (included for free in the NanoTrader trading platform) is recommended to identify stocks which are currently rising (or falling) sharply.

As an example, here is a screenshot of the outperformers in the MDAX. Second tier stocks are sometimes even more interesting than the DAX 30 main stocks. The Techscan tool filters out the winners (or losers) of the day or week and allows the trader to see at a glance which stocks are currently in demand. Trends can often last several days. Stocks that have already risen 5% are therefore not necessarily "too expensive" as pointed out by Nobel prize winner Prof. Eugene Fama.

Trends in momentum stocks often take place without significant setbacks, as illustrated by this chart of Hugo Boss stock.

Not only in the domestic market do equities offer greater diversification and more trading opportunities. A good CFD broker will offer the trader access to the most important international markets. For example, the trader can benefit from high beta US equities. The beta indicator shows how much a financial instrument fluctuates in comparison to an index, for example. The Apple share may serve as an example here (chart below). After the downward gap on April 19, the opportunities here were clearly on the short side. The security lost more than 16 dollars in value in a few days. This is an above-average movement.

Some traders focus on specific stocks. They trade the same stocks over and over again. Nevertheless, if one of the stocks suddenly shows only little volatility, these traders need to have the flexibility to take this stock out of their "trading basket" and add another stock.

CONCLUSION

CFDs on stocks offer several advantages that an index trader or forex trader does not have. Thanks to the TechScan, the stock trader can filter out the stocks that are currently doing well in the market and thus compile a list of tradable stocks. In theory, he can choose from thousands of stocks worldwide. In addition, CFDs on stocks are eay to understand. The trader can take both long and short sell positions. You can make a personalized newsletter and receive technical analysis signals via e-mail.

The WL Vola Open strategy is a clear and precise strategy for stocks traders who like immediate action in the first minutes after the market has opened.

"I have already familiarized myself a little with the platform and would like to inform you that this is the best platform I have been able to work ont." - Peter

"The trading platform is simply ingenious. You find your way around immediately. The support is competent, friendly and fast. I could list further positive factors for hours, but would like to leave it at that." - Christoph

"The application of the sentimentors on the platform is simply ingenious." - Manfred