Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Building a Babypips strategy

Converting a strategy description from a website or a book into a working strategy on a trading platform is not always easy. Nearly all trading platforms, including MT4 and NinjaTrader, require the user to start programming. Not so NanoTrader. NanoTrader consists of building blocks. The trader can silmply assemble these building blocks and start trading. It is also possible to automate any strategy without coding (programming).

In this article we convert a trading strategy described on the Babypips (Babypips.com) website into a fully working strategy, ready to trade. This will take 4 ½ minutes.

A Babypips forex trading strategy

In this Babypips article the author explains the "SMA Crossover Pullback" strategy. The strategy is traded by a contributor to the website.

Towards the end of the article, the author writes: "... putting our coding skills to the test.... " to program the strategy in his MetaTrader platform. Sounds like a tough job! Not in NanoTrader. In NanoTrader this strategy can be created without coding. Users who are familiar with NanoTrader can do it in less than 10 minutes.

The rules of the strategy

The SMA Crossover Pullback strategy described on Babypips is traded on a 1-hour chart.

The strategy uses three technical analysis indicators: a simple moving average of the last 100 periods (SMA) (blue), a moving average of the last 200 periods (magenta) and the stochastic indicator (14,3,3).

A buy signal occurs when the stochastic indicator breaks the 25 level from below after the SMA 100 (blue) has intersected the SMA 200 (magenta) upwards. When the SMA 100 > SMA 200, the chart background is green.

A short sell signal occurs when the stochastic breaks the 75 level from above after the SMA 100 (blue) has cut the SMA 200 (magenta) downwards. When the SMA 100 < SMA 200, the chart background is green.

This example in EUR/USD shows two crossing moving averages and the subsequent trading signal based on the stochastic indicator. The first signal is a buy signal. The stochastic indicator crosses the 25 level after the two moving averages have crossed. The second signal is a sell signal. The stochastic indicator dips below the 75 level after the two moving averages cross.

The Babypips SMA Crossover Pullback strategy uses a profit target and a stop loss. The profit target is 300 pips above the entry price. The profit target is 150 pips below the entry price. This results in a risk/reward ratio of 2:1. If the market price moves 150 pips in the direction desired by the trader, he can move the stop to the entry price.

What components does the trader need?

To convert this description the following components are required:

- A 1-hour chart of the forex pair.

- A stochastic indicator with levels 25 and 75. The stochastic indicator triggers the signals.

- A crossing moving average. The crossing moving average filters the signals. If the SMA 100 > SMA 200, buy signals are acceptable. If the SMA 100 < SMA 200, a sell signal is acceptable.

- A command that automatically opens the position if all criteria are met.

- A command that automatically places bracket orders (target 300 pips and stop loss 150 pips) after the position is opened.

- A command that automatically moves the stop loss order to the entry price if the market moves 150 pips in favour of the trader.

Unlike Metatrader, all these elements can be created in NanoTrader without programming.

Build and trade the strategy without coding

This video shows you how to build the strategy without coding.

In the video you can see the BEtrail Stop (BEtrail stands for break-even trail). The BEtrail Stop automatically performs what Babypips asks for: Moving the stop order to the entry price if the market moves a predetermined number of pips in favour of the trader.

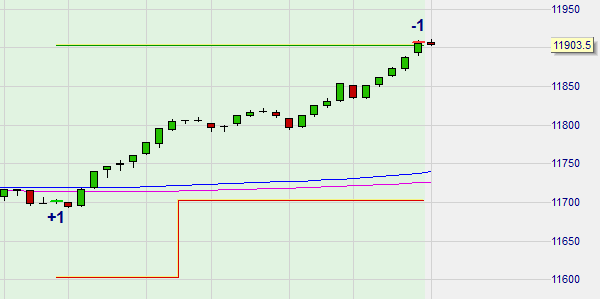

This example shows the BETrail Stop (red) at work. It is one of the 15 different stop order types available in the NanoTrader. No programming required.

Feedback from traders

"I am enthralled with the possibilities NanoTrader offers." – A.G.

"Thank you again for your service. It's been years and I'm still as satisified as ever." – M.N.

Thank you for your clear explanations. WHS really has the BEST CUSTOMER SERVICE. – S.K.

People also read

- Trading the FXStreet forecast

- Making market volatility visible

- How John Bollinger invented the Bollinger Bands and more