Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Uncontrollable inflation – Ghosts and Ghostbusters

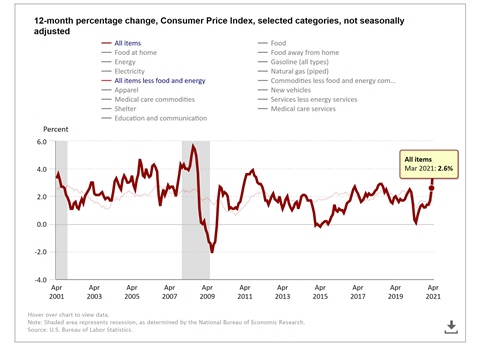

The world has come to take low inflation for granted. While in the 70s, annual inflation in rich nations averaged 10%, it stayed at just below 2% in the last decade. With more and more people getting vaccinated, governments worldwide pumping money into the economy, and forecasts of an unprecedented rebound in major countries, consumers are expected to embark on a spending spree beyond firms' capacity, causing prices to rise. The investor community is spooked by the threat of uncontrollable inflation, putting unprecedented pressure on stock markets performing at all-time highs. The American Rescue Plan by the new Biden administration sets out to invest an eye-watering sum of $1.9 trillion as coronavirus relief. In response, the USA's Consumer Price Inflation (CPI) figure for April reads 4.2% year-over-year. The highest number since the Great Recession from 2007 to 2009.

An "overheating" economy and markets?

The combination of the sudden jump in price level with the extreme fiscal stimulus adds to people's concern over an overheating economy.

Let us examine this potential "overheating" in more detail. This scenario requires prices across most sectors to increase for a sustained period. If the April inflation increases are only temporary and limited to one or two sectors, we expect the inflation data to return to previous levels soon.

Inflation measures are based on an annual growth rate, but the CPI figure can fluctuate dramatically due to temporary supply and demand imbalances. Looking at the current situation in the pandemic, explosive increases in food and energy prices could dominate the CPI, even if other sectors are less impacted.

Experienced investors and central banks often exclude the food and energy sector from their inflation analysis and look at the much less volatile core CPI.

Removing noise from the inflation analysis

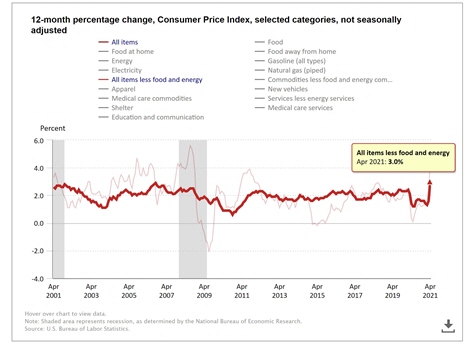

Core-CPI stayed below the 2% mark during the pandemic but climbed up to 3% in April 2021. Another record high since the Great Recession. However, we start from an exceptionally low base as prices for goods and services collapsed in April 2020 after the first wave of the pandemic began.

Is this now proof that the ghosts of uncontrollable inflation are upon us?

Let us examine the situation a bit more. The monthly core CPI exploded to 11.6% in April 2021 on an annualised basis. Another record high after the Great Recession. In contrast, inflation numbers before April 2021 are much lower. The surge in April implies that some prices must have driven this sudden growth.

The real root cause of inflation growth

The sector-by-sector analysis reveals what has caused this growth. The monthly core-CPI inflation for used cars and trucks has surged by more than 200% and the transportation services sector by 46%. All other price increases stayed within normal parameters.

Price increases in the used vehicles and transportation services sectors are not expected to be permanent. Businesses and individuals are switching back to their pre-pandemic lifestyles while supply increases result in a more balanced demand and supply scenario. Price increases in these sectors are temporary.

Since we do not currently see a rationale for an extended period of shortage in either used cars or transportation services, upward price pressure will gradually disappear. With it, the ghosts of inflation – at least for now.

Graphics – Source: US Bureau of Labor Statistics.

CPI, all categories, 2011 - 2021

Core-CPI, excluding food and energy category, 2011 – 2021.