Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Trading a market range break-out

A market moving sideways will break out at one point in time. The trader does not know if the break-out will be upwards or downwards. Both are possibile. The NanoTrader offers the possibility to place an order in both directions. If one order is executed, the other is automatically cancelled.

The advantages of one-cancels-other (OCO) entry orders:

- Catch every break-out - whatever its direction.

- Slide orders in the chart to place them precisely on support and resistance levels.

- Visual reminder indicates which orders are linked.

- If one order is executed, NanoTrader cancels the remaining order.

- No programming required.

1. TRADING A BREAK-OUT

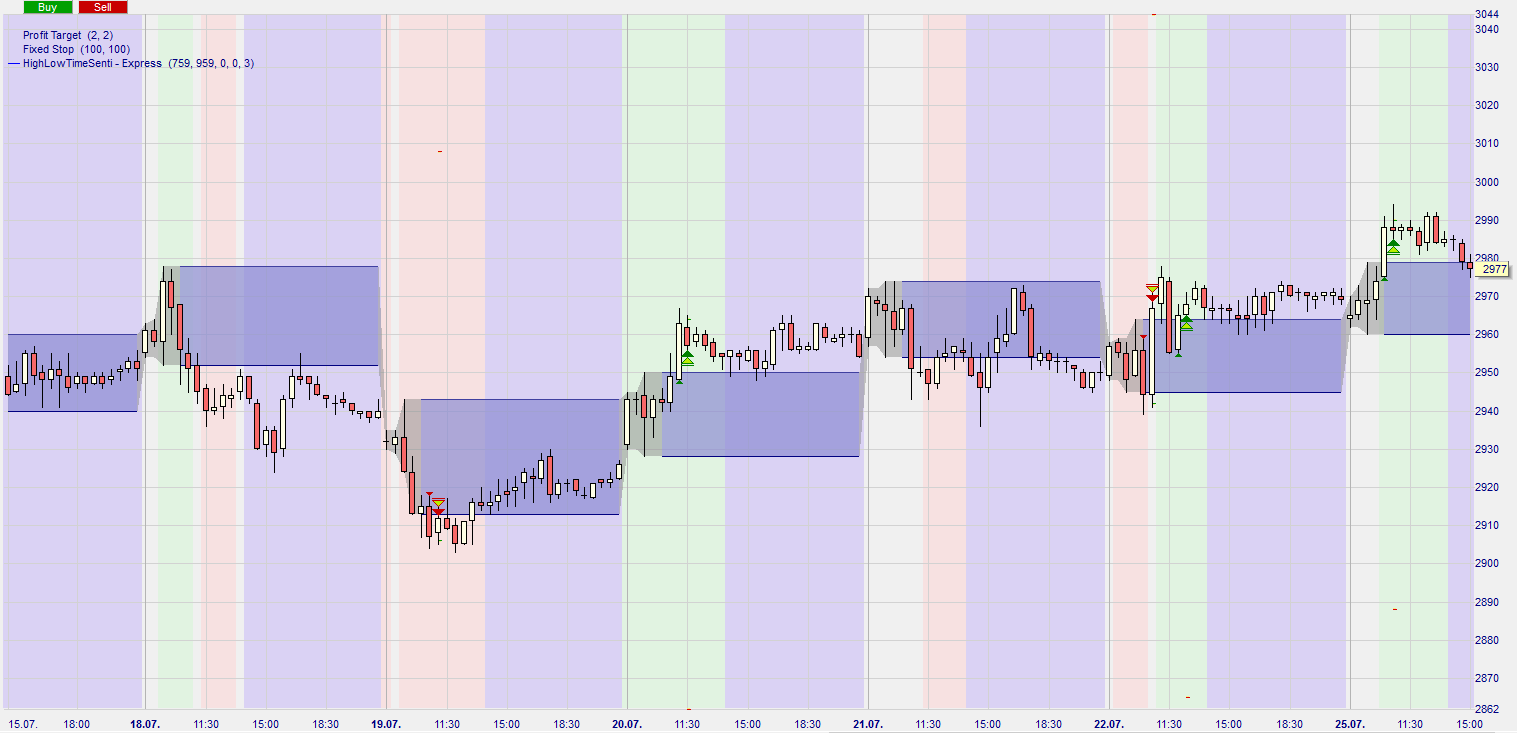

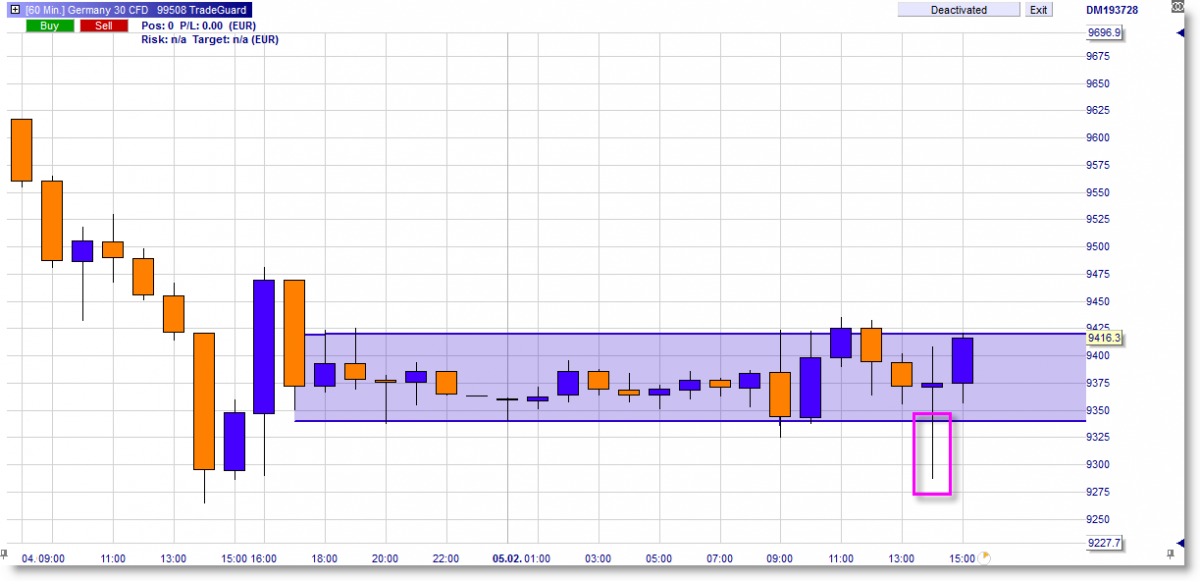

Traders who trade both break-out directions tend to put a less ambitious profit target on the break-out which moves against the trend. This example shows the DAX index in a range. The potential upwards range break-out and the corresponding target and stop levels are drawn in green. The potential downwards range break-out and the corresponding target and stop levels are drawn in red.

2. BE READY FOR THE BREAK-OUT... USE THE OCO ENTRY

Once he has identified his six levels the trader only has ... to wait. Instead of waiting and suddenly scrambling to place the correct combination of orders when the break-out occurs, the trader can use a unique feature of the NanoTrader platform: the OCO Entry.

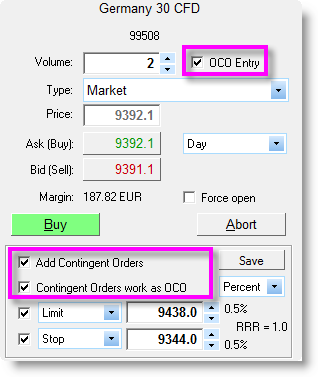

OCO stands for order cancels other. When an order is executed the other order is cancelled. Unique to the NanoTrader is the fact that OCO can be used for entry orders i.e. orders to open a position. OCO entry can be selected in the order ticket*.

In short, the trader places a stop buy order at the top of his range (for the upwards break-out) and a stop sell order at the bottom of his range (for the downwards break-out). When one of these orders is executed, the other is cancelled automatically. Traders can also instruct the NanoTrader platform to automatically place the stop and target orders once a position is opened. This is done by selecting “Add contingent orders” in the order ticket.

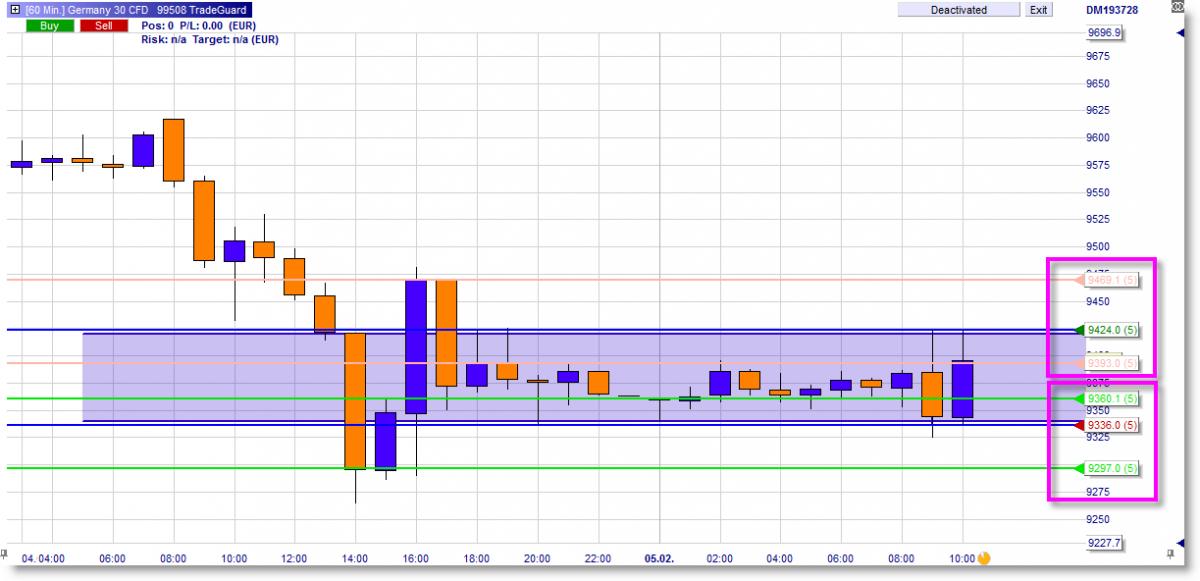

This example shows the two entry orders in place. One placed at the top of the range and one placed at the bottom of the range. The contingent stop and limit orders related to each entry order are also visible. The trader is now 100% ready for whatever break-out occurs.

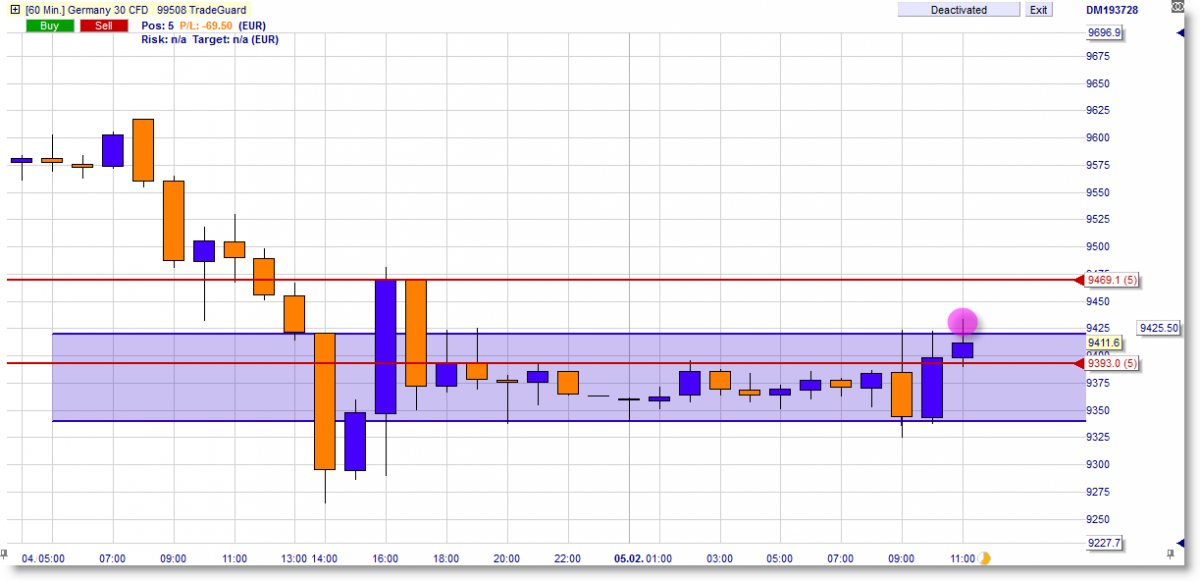

A bullish break-out occured. The NanoTrader automatically (1) cancelled the short sell entry order and (2) placed the contingent stop and limit orders.

The market does not go up. In the next candle the position is stopped out with a loss.

Two hours later another break-out occurs. This break-out does reach the profit target.

3. THE ORDER TICKET

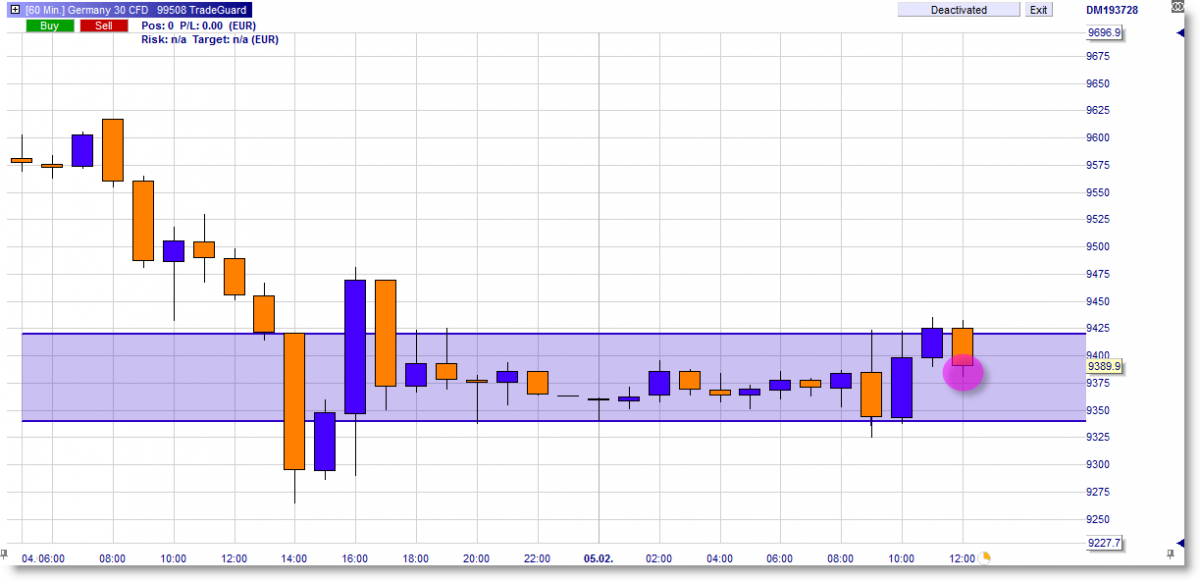

This is the order ticket. It shows where to select the unique “OCO Entry” and where to select the contingent orders.

"I really appreciate, as do many of your clients, I suppose, the fact that the NanoTrader never stops evolving."

– V.F.