Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Stock market hours + When is the best time of day to trade?

Stocks are traded all over the world on different exchanges – the stock market hours will reflect each exchange’s opening and closing times. Discover when the trading hours for stock markets all over the world – including the NYSE, NASDAQ and all other major world exchanges.

If you want to know about the markets opening hours, read on. Read these articles if you want to know, which days are best for trading and which times during any given day are best for trading.

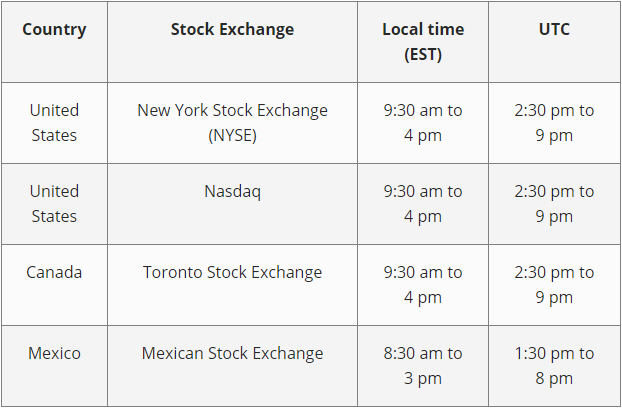

Stock market trading hours vary by exchange and geographical location. Often when people are talking about the stock market, they’re referring to US exchanges – such as the NYSE or NASDAQ – which are open from 2.30 pm to 9 pm (UTC).

While these are the ‘normal’ trading hours for shares, there is activity outside of this session. Most stock exchanges will offer pre- and post-market trading, Monday to Friday. These sessions don’t work in the same way as the regular hours, as buyers and sellers are paired directly together through electronic communication networks, rather than going through brokers or trading providers.

Most trading hours will run from Monday-Friday, five days a week. There are no regular trading hours for stocks on Saturdays or Sundays. So, if you see news about stocks being up or down over the weekend, it’s most likely stock futures – which begin trading at 11pm on Sunday night (UTC).

The opening hours of the main stock markets....

US stock market hours

The NYSE and the NASDAQ are the two largest American exchanges, both of which are located in New York City. Their regular stock trading hours are Monday to Friday 9:30 am to 4:30 pm EST (2:30pm to 9pm GMT). Most US exchanges do not close for lunch, but there is typically less trading in the middle of the day. Most liquidity for the US session is found at the opening and closing bells.

The US session is shorter than the UK market hours – totalling just 6 hours and 30 minutes. A shorter window of trading leads to less volatility, as more news occurs while the market is shut, giving everyone time to digest the information before they make a trade.

Power hour stock market

Power hour is the time just before a market closes. A lot of share traders will look to trade within power hour as it tends to see a lot of volatility and liquidity as market participants adjust their positions before the market shuts. While power hour will depend on each individual stock exchange’s opening hours, the global power hour is generally considered to be between 7 pm and 8 pm (UTC) when the US stock market is winding down.

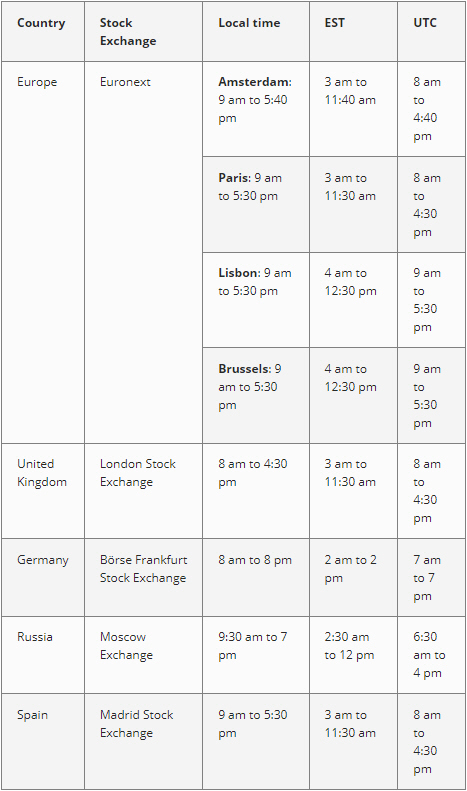

European stock market hours

The European stock market is open for the longest period of all regions as it’s home to a vast number of exchanges. The Euronext is the largest, which represents a number of markets such as Amsterdam, Paris, Lisbon and Brussels.

The Euronext exchange doesn’t close for lunch and isn’t open on weekends. Just like the UK stock exchange hours, Euronext is open for much longer than normal hours – totalling 8 hours and 30 minutes of trading time.

Although not part of the European Union, the London Stock Exchange and Moscow Exchange are European exchanges too, so you’ll see them grouped into the stock hours.

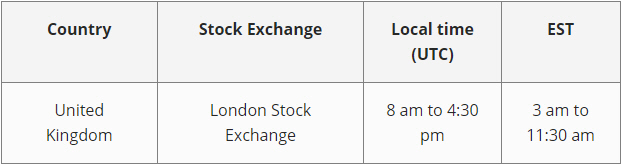

UK stock market hours

The London Stock Exchange opens at 8 am UK time, and closes at 4:30 pm – with a break from 12:00 pm to 12:02 pm. The London stock market hours are some of the longest in the world – with a total of 8 hours and 28 minutes of trading time.

Most other exchanges only open for between 5 and 7 hours. These longer hours mean there is likely to be more volatility, as more news occurs within the time that the market is open, giving traders and investors time to adjust positions.

The London Stock Exchange does close for lunch, but unlike markets in Asia and the Middle East which close for an hour, the LSE only closes between 12:00 pm and 12:02 pm. The LSE is not open on weekends.

Asian stock market hours

Asian stock market hours fall into the early shift of global market trading. In a lot of Asian countries, lunch breaks are common practice so it’s important to know when trading will stop and restart. There is typically less liquidity anyway during the middle of the day, as most volume is found at the start and end of the day.

In some other Asian countries – such as India and South Korea – lunch breaks were banned in order to encourage more market activity.

Most Asian trading hours are only between 4 hours and 6 and a half hours long. These shorter trading sessions see much less activity than other global sessions.

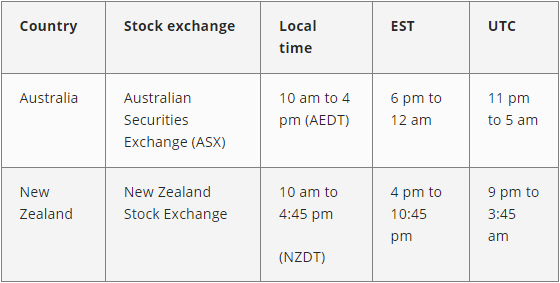

Australian stock market hours

The Australian stock market is open from 10 am to 4 pm, Monday to Friday, Australian Eastern Daylight Time. The Australian market is open for 6 hours per day, while the New Zealand market is open for 6 hours and 45 minutes – both are relatively average opening hours.

South American stock market hours

These hours differ slightly for some South American Exchanges, as although they largely overlap with the larger North American markets, they start and finish at slightly different times.

Unlike its North American counterparts, the Brazil Stock Exchange is open for longer than most global markets – with a total of 7 hours 55 minutes. This means the exchange sees far more volatility than others as news is digested throughout the trading day.

What is (are) the best day(s) to trade?

The Day Volatility tool indicates for any instrument which days of the week are the most volatile. The most volatile days of the week are the most interesting for traders. The tool can be used for market indices, forex pairs, commodities and even individual stocks.

This example shows Apple. Friday is the most volatile trading day. The average volatility of Apple on a Friday is currently 3,4%.

What is the best time of day to trade?

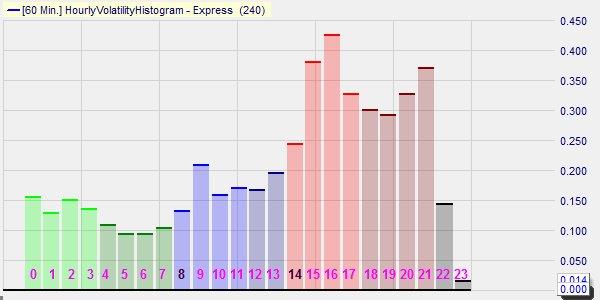

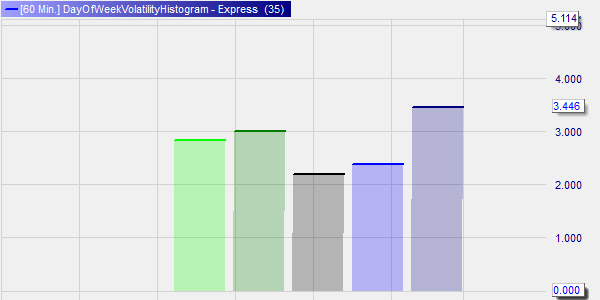

The HVH (Hourly Volatility Histogram) provides the answer by calculating the hourly volatility for each market. The most volatile times of the day, are the most interesting for traders. When markets move, opportunities arise. Using the HVH tool traders can literally see when a market is volatile and how its volatility compares to the volatility of other markets.

This HVH example shows the DOW market index. The two most volatile hours are the 15th hour (15h00-15h59) and the 16th hour (16h00-16h59). The hourly volatility during these hours is 0,38% en 0,43% respectively. When the DOW quotes, for example, 24 000 this implies that the DOW moves on average 103 points during the 16th hour.