Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Is 'buy the dip' a good trading strategy?

In trading terminology, ‘buy the dip’ refers to the tactic of buying (or going long on) an asset that has experienced a recent depreciation in value, in the expectation that the same asset will soon resume an upward trajectory. Read on as we explain more about ’buying the dip’.

What does ‘buy the dip’ mean?

‘Buy the dip’ means targeting what was previously a rallying asset that has suffered a recent price reversal – and backing it to turn the corner and recover its value. Essentially, you’re trying to take advantage of the new lower price before its upward trajectory resumes. A buy-the-dip trade has to be carefully timed: you are hoping to catch the very point when you believe the asset is poised to go back up.

Is timing everything when you buy the dip?

Timing is very important. The most successful buy-the-dip trades are those that precisely catch an interim trough. However, it does not necessarily matter if the asset continues to lose value for a short period after placing the trade so long as a healthy recovery does follow. And you can also place a buy order shortly after the market has turned upwards and still book in an eventual profit – so long as it continues to head in an upwards direction. The strategy can apply to any tradable asset, be it a stock, forex pair, commodity or index.

Is buying the dip a good idea?

Buying the dip can be a good idea if you have carefully researched an asset that appears to have powerful credentials to make an imminent recovery. There are plenty of historical examples that illustrate when buying the dip has been a sound idea. On July 19, 2021, the Dow Jones Industrial Average stock index tumbled 2.1%, suffering its worst day since the previous October, as investors grew concerned about the Covid-19 delta variant. The following day, the market rebounded solidly and closed 1.6% higher.

Buying the dip is not a fool-proof strategy, however, and comes with a high risk tariff. As with any type of strategy, you should consider deploying stop-loss and take-profit orders when opening an initial position. There are also plenty of historical examples when buying the dip would not have produced favourable results.

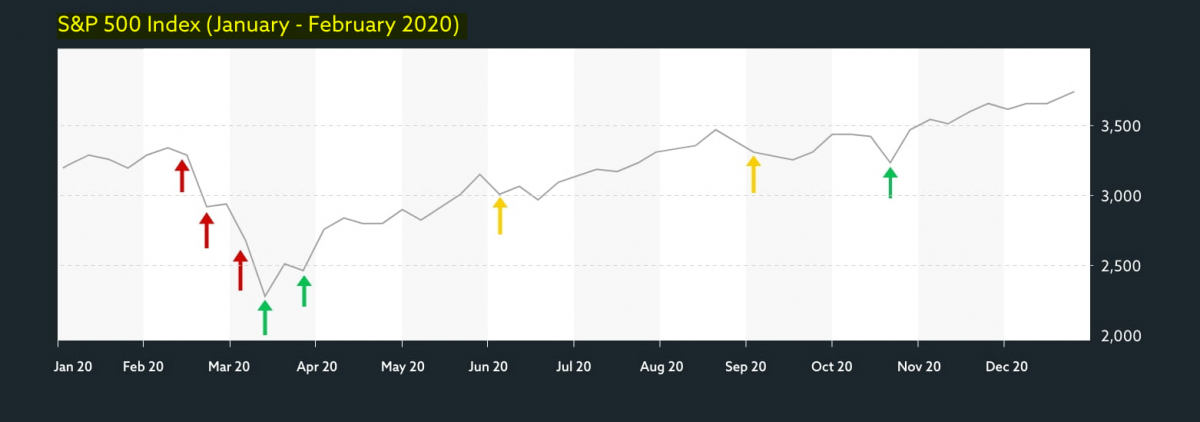

In the graphic displayed above, the first three arrows marked in red represent dips in the S&P 500 during the early part of 2020.

The onset of the Covid-19 pandemic meant that these turned out to be the start of a steeper market dip. They were bad moments for swing traders – those attempting to capture gains in a relatively short timeframe – to buy into the market. Traders who buy during a market rout should know stocks may continue to fall before they rebound. We’ll look at this more closely in due course. Bear in mind too that you might miss your best chance of booking a healthy profit if you’re obsessed by waiting for the dip. Even if you could theoretically emerge in the black by biding your time, you could pass up the opportunity for bigger rewards.

How to buy the dip

To buy the dip you need to either employ technical analysis – that is, using certain charting indicators – or fundamental analysis, where the actual market conditions are assessed to determine the ‘true’ value of an asset. You then place a buy order exactly as you would in any other circumstances when you believe the asset in question is close to completing a temporary decline.

When should you buy the dip?

When you elect to buy the dip, you are taking a long-term favourable view of an asset’s value and future performance. Typically, a perceived good moment to buy the dip is when a market – whether a currency pair, an equity or a commodity – is enjoying a long-term bull run but has encountered some headwinds. This may be the result of broader economic concerns, profit-taking by people who bought at the start of the bull run or as a reaction to specific negative news concerning the asset. Whatever the reason behind this decline, you buy the dip because you believe the ongoing slide in value of the asset is not part of a continuation but will soon spike back up.

When were the best times to buy the dip?

Some of the best times to buy the dip in 2020 are indicated by green arrows in the graphic above. The first two opportunities arose amid the fear and uncertainty triggered by the first wave of coronavirus lockdowns, while the third was more of a gentle market correction during a bull run. Finally, look carefully at the two orange arrows in the same graph. These indicate neutral buy-the-dip opportunities – ones that could have resulted in profits but only if the position was closed in a timely fashion.

Buy the dip vs buy and hold

‘Buy the dip’ is a tactic favoured by traders who have looked into a stock and believe they can open a position at what is effectively a discounted rate. ‘Buy and hold’ tends to be more a long-term play for investors who have savings they can afford to put away over a substantial period. A buy-the-dip trader typically seeks various opportunities to make successful trades, but as with all such opportunities the key is timing the entry and exit points astutely. On the other hand, a buy-and-hold investor could put money into a portfolio of shares and keep that investment ticking over for 10 or 20 years.

Buying the dip using technical analysis

Technical analysis is often used as a framework to inform buy-the-dip opportunities. Here is an example of a three-step strategy that might help guide you.

- Consider the long-term trends: The longer a trend has been in place, the more reliable it tends to be. One way to accurately measure it is to apply long-term moving averages (MAs) – such as a six-month or one-year MA – to proxy the long-term trend.

- Look for static support levels: Static support is a level that a market has shown a tendency to bounce upwards off when its price is falling. When dynamic and static support occur at the same point, the chances of a successful buy-the-dip trade are often augmented.

- Top-heavy candlesticks suggest recovery: Candlesticks with long lower shadows often indicate supply-side exhaustion. The shadows demonstrate that despite considerable selling, there remains ample demand in the system at the lows to soak up all of the supply, and to push prices up again.

Buying the dip using fundamental analysis

Here are some established scenarios that provide circumstances conducive to executing buy-the-dip plays.

- Central bank stimulus: When the central bank is increasing the money supply, this is generally good for the markets. More money floating around means more of it finds its way to stocks and other assets.

- Market stimulus: Market stimulus is similar to central bank stimulus. Markets tend to react positively to corporate tax cuts, or reductions in consumer taxes.

- Singling out a stock: Individual stocks can face selling pressure if there is very specific negative news that only concerns the company in question. If the sector in which it operates is performing well, a price recovery could be on the cards.

Buying the dip in a bull market

In a typical bull market, the price isn’t dropping below prior low points and is instead making new highs following dips. This is a pattern that provides buy-the-dip opportunities. When this uptrend pattern falters, and the price starts hitting lower highs or lower lows, buying the dip is riskier, because the price has switched to an overall downtrend and a possible bear market is looming.

'Catching a falling knife'

A catchphrase that can explain why a buy-the-dip play has gone wrong is ‘catching a falling knife’. This happens when a previously buoyant asset suddenly crashes. Based on previous trends and indicators prior to the crash, you could speculate that the sudden price fall is temporary and thus attempt to profit from a recovery. But what if you get it wrong? Say the price continues to crash much, much further. In situations like this, when using leveraged trades, there is a danger you could suffer a margin call unless a stop-loss order has been set. In general, managing risk is very important with all buy-the-dip trades, particularly for traders using leverage and those who are less experienced. Keep across our educational material to ensure you know all about risk management before you attempt to buy the dip.

People also read

- What you need to know about the change to the DAX 40 index

- Do experienced investors invest in cryptocurrencies?