Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

A DAX and DOW scalping strategy

The D&D Range Bar Scalping strategy should get the attention of every day trader. It is one of the few trading strategies, which are capable of finding trading opportunities even when the market is not volatile. Another, extreme example is the MAD Rebound strategy. This interesting strategy actually prefers low volatility.

These are the advantages of the D&D Range Bars Scalping strategy:

- Range bars are used.

- Even in periods of low volatility, the strategy detects trading opportunities.

- Positions are only traded in the direction of the trend.

- Positions are only opened when the market breaks out of a range.

- Positions are managed with multiple profit targets in order to maximize profit.

UNCONVENTIONAL RANGE BARS

Range bars are charts which are only drawn when the market price moves by a number of points defined by the trader. Time is not relevant. Only price movement is relevant.

The strategy uses range bars which are only drawn when a 5-point price movement occurs. A 5-point movement is small compared to the value of the DAX and DOW. The trader therefore ‘sees’ and is able to trade small market price movements, even when volatility is low. This is a non-traditional use of range bars. Range bars are more commonly used to actually not show low volatility periods in charts.

THE SUPERTREND

To determine the trend the strategy relies on the SuperTrend indicator. Positions are only opened in the direction of the trend.

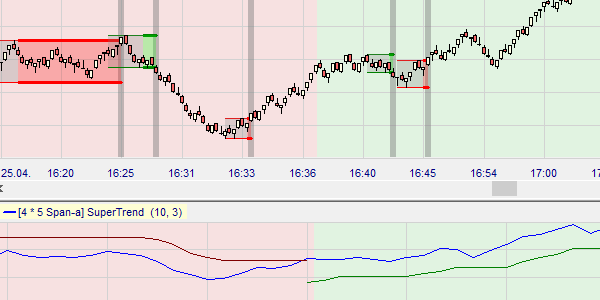

This illustration shows the SuperTrend indicator below the main chart. In the case of a positive (bullish) market trend the background is green. In the case of a negative (bearish) trend the background is red. NanoTrader replicates these colours in the main chart.

A BREAK-OUT OCCURS

Positions are only taken when a range break-out occurs. The NanoTrader automatically detects and draws trading ranges and break-outs.

LOCKING IN PROFIT

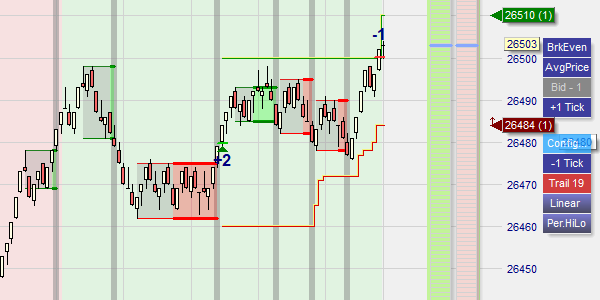

Positions are managed with two profit targets and a stop loss to maximize profit. The NanoTrader's TradeGuard+AutoOrder function places all these orders automatically for the trader. The trader can still manually change or cancel the orders should he want to.

This illustration shows a position which has already reached its first profit target. The trader converted his stop loss order in a trailing stop loss order by using the blueTactic button 'Trail'.

CONCLUSION

Its tradability in low volatility situations make this DAX and DOW scalping strategy interesting.

TIP

If you are not familiar with automating strategies or scalping consider the PlayBack function. PlayBack in the NanoTrader allows traders to download historic data and to 'replay' trading days. Traders can get familiar with strategies before applying them on their live account.