Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Dr Alexander Elder – Bull Power and Bear Power

The Elder Ray Index Trading signal was developed by the famous trader and author Dr Alexander Elder. The two main components are the Bull Power Indicator and the Bear Power Indicator. These indicators show whether it is the bulls or the bears that are currently dominating the markets.

These are the advantages of the Elder Ray Index:

- A trading signal developed by a well-known trader.

- The quality of the signal, with the fourth condition activated, seems strong.

- The signal can be used in any time frame.

- The signal can be used for any instrument.

- The trading signal is FREE.

Trading Signal by Dr. Alexander Elder - The fourth condition is key

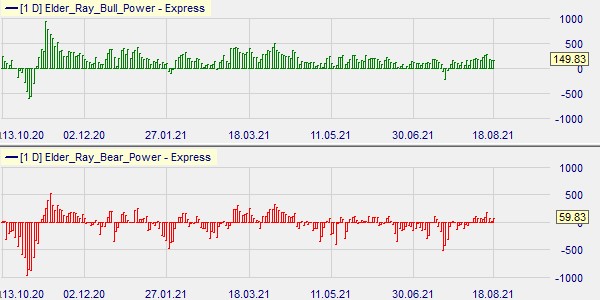

The Bull Power and Bear Power indicators are displayed below the main chart. Bull Power is calculated by subtracting the exponential average (EMA) of the day from the daily high. If the daily high is above the EMA, the Bull Power is positive and the histogram is above the zero line. Bear Power is calculated by subtracting the EMA of the day in question from the daily low. If the daily low is below the EMA, the Bear Power is negative and the histogram is below the zero line. Elder recommends an EMA with a length of 13 periods.

This example shows the Bull Power (green) and Bear Power (red) indicators by Dr Alexander Elder.

When to take a position

For a buy signal, the following conditions must be met:

- The market price (EMA) must be rising.

- Bear Power is negative (below zero) but rising.

- The last Bull Power bar is higher than the previous bar.

For a short sell signal, the following conditions must be met:

- The market price (EMA) is declining:

- Bull Power is positive (above zero) but falling.

- The last Bear Power bar is lower than the previous bar.

The important fourth condition

For traders who want a strong confirmation for the trading signal, Dr Alexander Elder has added an optional fourth condition. The fourth condition reduces the number of trading signals but increases the quality of the signals.

For the buy signal:

4. The Bear Power indicator shows a bullish divergence with the market price. This means that the indicator is going up and the price is going down.

For the short sell signal

4. The Bull Power shows a bearish divergence with the market price. This means that the indicator is going down and the market price is going up.

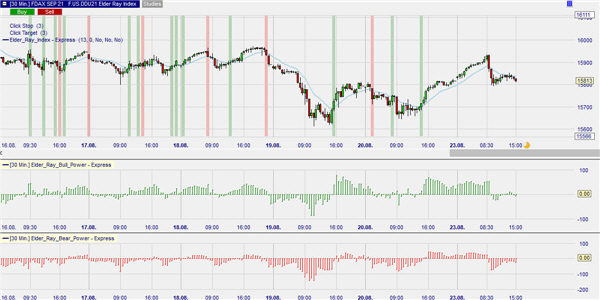

This example shows a chart with several sell (=red) and buy (=green) signals generated by the Elder Ray Index. The fourth condition is used in this trade. The condition is set to seven periods. There are some VERY nice trading signals.

This is the same example as above. The fourth condition mentioned by Dr Alexander Elder is not activated. More trading signals are generated, but the quality of the signals is significantly worse. It is therefore strongly recommended to activate the fourth condition.

People also read...

“Every trader has strengths and weakness. Some are good holders of winners, but may hold their losers a little too long. Others may cut their winners a little short, but are quick to take their losses. As long as you stick to your own style, you get the good and bad in your own approach.”

- trader Michael Marcus