Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Everything you need to know before trading oil stocks

Oil stocks represent listed companies involved in the exploration, drilling, refining and sale of oil. Examples of major oil stocks are Shell, BP and ExxonMobil, whose price fluctuations provide a useful insight into the supply and demand forces impacting the commodity.

Oil stock trading is the attempt to profit from these stock prices rising or falling. Like other equities, oil stocks can also be traded via CFDs, over a range of timeframes. Traders and investors may prefer to focus on the oil company stocks rather than the raw material itself for a variety of reasons, from capital gains benefits to the varying fundamental factors that hit individual companies.

Trading oil stocks

Upstream vs downstream oil stocks

An important distinction to be aware of before trading oil stocks is the concept of upstream vs downstream oil companies, as well as midstream oil companies. These terms represent business operations within different parts of the industry.

Here are a few examples of where major oil stocks fit into these categories.

- Upstream: ConocoPhillips, Marathon Oil, Apache, Tullow Oil

- Downstream: Marathon Petroluem, HollyFrontier, Valero, Sunoco

- Midstream: Enterprise Midstream, Kinder Morgan, Enbridge, Williams Companies

- Integrated: ExxonMobil, BP, Chevron, Total

Upstream oil describes exploration and production companies, which seek out oil sites globally and drill wells for underground or subsea extraction.

Upstream oil companies are the most impacted by oil price fluctuations. Low prices of the commodity can result in fixed production costs exceeding revenue from oil sales, meaning damaging losses and potential stock price falls. High prices, on the other hand, can naturally result in significant profits, and stock price gains.

Downstream oil companies are those which refine the crude oil into component products such as gasoline, and/or distribute such products to the end user.

Since downstream operators are able to sell their refined products at a premium, and thus offsetting the effect of higher oil prices, they tend not to experience the same potential for losses as upstream companies, and may consequently see less volatility in their stock price.

Midstream oil companies fall between upstream and downstream and involve the processing, storage and transportation phases of the supply chain, whether dealing with crude oil or its refined components.

As with downstream companies, midstream operators are not as exposed to fluctuations in the raw material as upstream companies are. This is down to the nature of the contracts; fixed-term and long-term arrangements can encompass periods where the oil price stabilises after a bull or bear run.

Integrated companies combine the above processes, with some of the largest oil stocks in the world offering such diversified operations.

What affects oil stock prices?

Unsurprisingly, the factors that affect oil prices will invariably have a considerable impact on oil stock prices too. When oil prices rise due to high demand, low supply, or a combination of both, oil stocks will also rise. This is because oil companies’ profitability increases when the price achieved per barrel soars above the largely fixed costs of doing business. However, when oil prices fall, companies with upstream operations may suffer a disproportionate stock price hit, as outlined.

Here are some more factors that can hit oil, and therefore oil stock prices:

OPEC regulation

OPEC, the intergovernmental consortium of 13 major oil-producing nations, can have an influence on oil prices through its setting of production targets. For example, if OPEC reduces its production targets, supply can naturally be curtailed and the oil price will rise, impacting oil stocks in turn.

Global economic performance

Unsurprisingly, the demand for oil will be higher when global industrial activity is up, pushing up oil stock prices during periods of economic boom. Conversely, recessionary periods such as oil futures’ 2020 move into negative price territory, caused largely by plummeting demand during pandemic lockdowns (but also a production glut and limited storage capacity), will send oil stocks down.

Natural disasters

Natural disasters can create supply shocks that spell short-term fluctuations for both oil and oil stocks. However, disasters don’t necessarily hit all oil companies in a predictable or universal way.

For example, Hurricane Harvey in 2017 saw a fall in oil prices as refinery shutdowns caused speculators to predict reduced demand for US crude. However, the potential for other downstream players to profit from the difference between the low crude price and the premium afforded to gasoline, known as the ‘crack spread’, meant a stock price uptick for refineries such as Marathon Petroleum.

Meanwhile, Hurricane Katrina in 2005 caused temporary spikes in major integrated oil stocks such as BP and ExxonMobil as supply was curtailed, but all of these stocks had fallen again within a couple of months. Similarly, while 2020’s Hurricane Laura halted 1.6 million barrels per day of offshore production in the Gulf of Mexico, it only caused a temporary stock price disruption.

These instances highlight the need for traders and investors not to be hasty in opening positions after such fundamental events, as the impact does tend to be temporary.

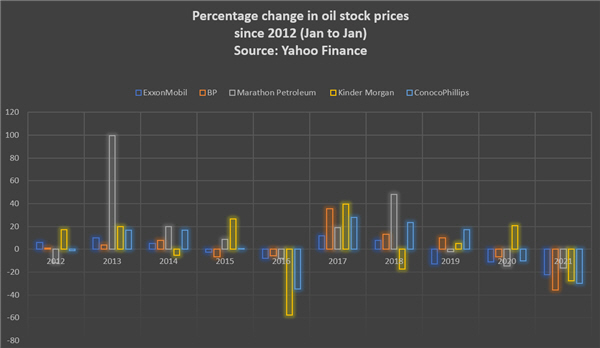

Oil stock performance year-on-year

Here, find out the year-on-year performance across a selection of oil stocks with upstream, downstream, midstream and integrated operations. The chart shows data adjusted for dividends and stock splits.

Do you want to trade oil stocks?

- Open a WH SelfInvest CFD-Forex account or Stocks-Cryptos account

- Use the Tradewizard to place your first trade (free demo)

- Protect your position with the automated bracket orders.