Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Find and trade the most volatile stocks

When market indices vary by more than 4% per day, as in the current period, it is certain that many stocks vary even more than the indices in which they are included. Experienced traders apply proven trading strategies to these stocks in order to exploit their high volatility and the first step for them is to identify these most volatile stocks. Why not follow their example? The NanoTrader contains 4 special screeners called 'Volatility and Trend' to assist you!

These are the advantages of the volatility and trend screeners:

- Ready-to-use

- Well-reasoned criteria base on extensive experience

- Corresponding strategies available

- Free

USING THE VOLATILITY AND TREND SCREENERS

1. LAUNCH THE STOCK SCREENER

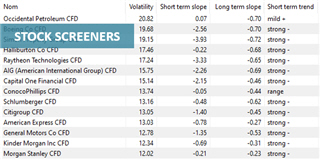

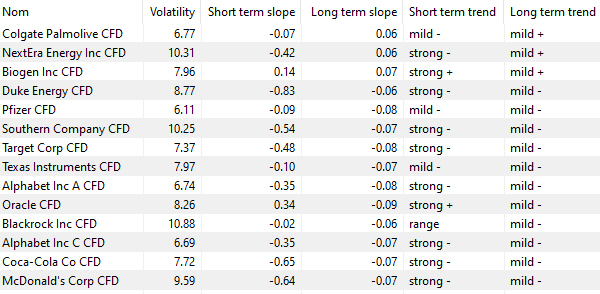

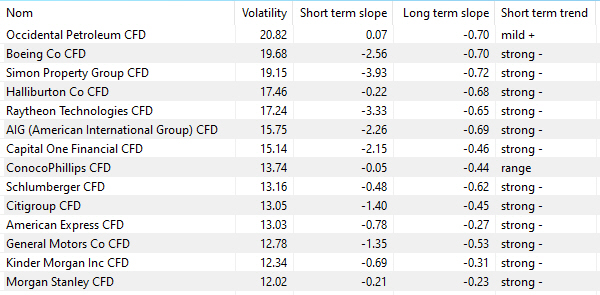

Let's launch, for example, the screener 'Volatility and Trend - US Stocks'. This screener automatically analyses 99 large US stocks. The screener displays the table below, which allows us to instantaneously find the most volatile stocks over the last 20 days.

Clicking on 'Volatility' displays the most volatile stocks at the top. These stocks are interesting to trade during the day or swing with trend following strategies such as the Black Candle strategy or the WL Vola Open strategy.

2. SORT THE RESULTS

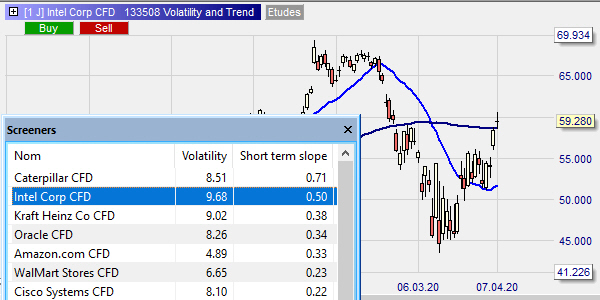

Clicking on 'Short term slope' presents new opportunities by ranking the shares according to the slope of the 20-day moving average (MA20). Below we can see that Intel Corp stock has the 2nd steepest MA20. This stock can be traded in swing with a strategy based on the Three Line Break signal that is only activated on the upside.

In conclusion, the Volatility and Trend screeners are easy to use and high value-added tools as they help traders to detect stocks for their trending strategies such as Black Candle and Three Line Break.