Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

The Inventory Retracement Bar (IRB)

The Inventory Retracement Bar was developed by Rob Hoffman to track down institutional investors. The tool tries to visualize when a counter-trend comes to an end and the institutional funds are back on the buying side. The tool gives concrete trading signals that can help the trader in his daily work.

Advantages of the Inventory Retracement Bar:

- Trading signals that are easy to use with clearly defined entry points

- Can be applied to any financial market

- Can be used in any time frame

The developer Rob Hoffman has won several international trading competitions. He also speaks frequently for top brokers and financial companies. Like many other traders, Hoffman was interested in the activities of institutional players and wanted to base his own trading decisions on their behaviour. This is why this strategy is designed to determine when institutional traders take positions out of the market (for liquidity or other reasons) and when they re-enter. The activity of these market actors usually leads to a short-term retracement against the trend. The Inventory Retracement Bar is therefore specially designed to find out when this temporary selling activity dries up and allows other market participants to resume the main trend. As institutional players repeat this type of operation constantly, it makes sense to develop an indicator that tracks their actions.

First identify the main trend

Before the tool is used, the direction of the main trend must first be determined. Hoffman analyses the slope of the exponential moving average over 20 days (EMA 20). The slope should be clearly rising (in an upward trend) or falling (in a downward trend). According to Hoffman, this slope should be at least 45°. He also considers that the trend in the next higher time frame should point in the same direction. According to Hoffman, there will be more false signals if the trend is in a sideways phase in a higher time frame.

How to use the Inventory Retracement Bar

In an upward trend, the trader should wait until the market breaks out one tick / cent above the high of the IRB. Hoffman wants the price to break within the next 20 bars according to the time frame used. If the trader is trading on a 5-minute chart, this should ideally happen within the next 100 minutes.

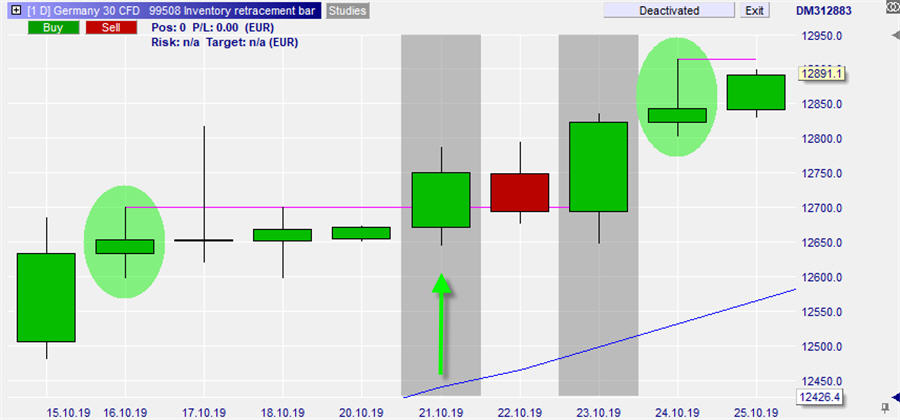

The signal to enter in the example on the DAX (picture above) was given when the market rose above the high of the IRB (arrow). The setup is the same for short entries. Here the trader should first identify a clear downward trend.

The Trailing Stop and Exit-Strategy

Although many traders close their positions as soon as they can book a certain amount of profit, Hofmann prefers a method that works on the basis of support and resistance and that is secured by a trailing stop.

The exact method is up to the individual trader. He could for example pull the stop to 90% of the profit as soon as significant resistance levels are reached (in an uptrend). Fibonacci levels can also be used to determine the price target, or daily or weekly pivots.

Stop Management

Once the trade is in the market it should not retrace the full length of the retracement and fall below the low of the IRB (in a long trade). If it does, the trader needs to close the position immediately.

Why the strategy works

According to Hoffman, the market tends to trade directionally with as few private traders on board as possible. This strategy is therefore effective in identifying areas where three things happen:

1. Traders with a long bias are distracted from buying when they see pullbacks from the highs. They are lead to believe that the uptrend is over.

2. The pullbacks give short sellers the false hope that the short positions they took earlier in the uptrend will now start to make profit.

3. Buyers who bought too high during the uptrend are stopped out during a pullback.

Once this has happened, and if a new IRB appears and breaks the high, there is a high probability that the market will go upward without the traders mentioned in the three points.