Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Trading volatility with the Eurex VSTOXX future

As volatility is back on the financial markets, our attention is naturally focused on anything that can allow us to exploit market movements but also to protect ourselves against declines in the value of our portfolios. Hence the interest of the VSTOXX index and its cousin, the Future VSTOXX. The VSTOXX index measures the volatility of the European equity markets and thus reflects investor sentiment on the European economic outlook. The VSTOXX Future allows investors to take positions in relation to the VSTOXX index. These positions can be either defensive or offensive, as we will see in this article.

Why should you be interested in the VSTOXX volatility index?

The VSTOXX Index and the future VSTOXX

The VSTOXX index is listed on the Eurex derivative exchange. It is a competitor of the VCAC index offered by EuroNext and the famous VIX index offered by the Chicago Board of Options Exchange. The VSTOXX Index measures the implied 30-day volatility of the EUROSTOXX 50 Index, a volatility that is deducted from the value of the premiums on EUROSTOXX 50 options.

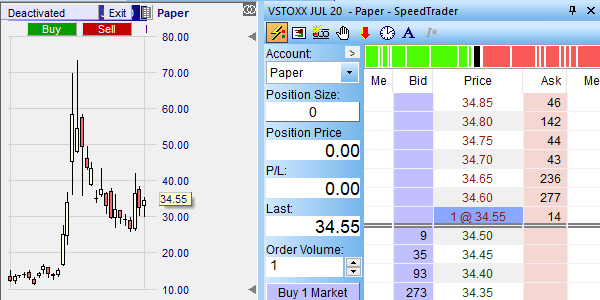

The Future VSTOXX is a contract that expires monthly. If you wish to keep a long-term position on the Future VSTOXX, you must arrange to roll the position once a month. The size of a Future VSTOXX is relatively modest. Indeed, a VSTOXX Future quotes 34.55 points (see example below) and one point of a VSTOXX Future is worth EUR 100, so the nominal value of a VSTOXX Future is EUR 3455. This modest size is convenient to protect portfolios whose value is close to a few tens or hundreds of thousands of euros. Daytime margins are EUR 450 and night-time margins are EUR 1300. The Future VSTOXX is traded Monday to Friday between 8am and 10pm. Its order book is very liquid as can be seen below.

Defending a portfolio with the VSTOXX Future

The Future VSTOXX is particularly suitable for protecting an equity portfolio against market downturns. To demonstrate how the Future VSTOXX can help us, let's put ourselves in the situation of an investor who owns a diversified equity portfolio and wants to protect it against a market downturn. To simplify our demonstration, we assume that the equity portfolio is equal to a long position on the Future EUROSTOXX 50 (FESX) with a nominal value of EUR 32000.

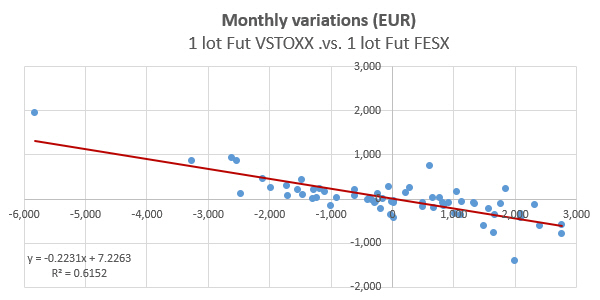

In order to protect himself, each month, against a market downturn, the investor must open and hold a long position on the Future VSTOXX until it expires. To evaluate the sensitivity of the Future VSTOXX compared to the Future FESX, we display for the period from February 1, 2015 to June 23, 2020, the monthly variations in EUR of the Future VSTOXX (including commissions) on the vertical axis and those of the Future FESX on the horizontal axis.

This gives us a scatter plot that reveals a negative correlation between the monthly variations of these two futures. Using the equation of the linear regression line in red, we deduce that a variation of the Future FESX of EUR 1000 corresponds to a variation of the Future VSTOXX of EUR -223.10. It therefore takes approximately 4 (= 1/0.2231) VSTOXX futures contracts to hedge a position in a FESX future contract.

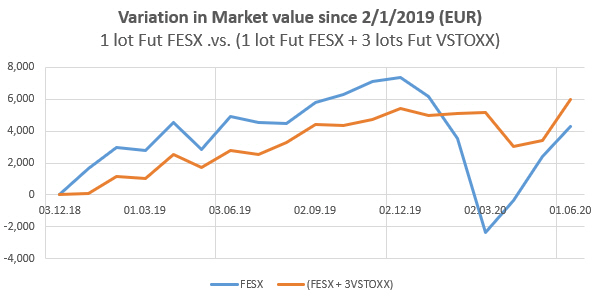

Let's now see how the value of our portfolio would have evolved if, since January 2, 2019, we had taken a long position on a Future FESX combined with a long position on the Future VSTOXX. Below, the blue curve shows the value of the FESX Future, month by month, including the sharp decline in March 2020 and the rebound that is underway. The orange curve shows the value of the pair made of the FESX Future and the 3 VSTOXX Futures.

We got what we've been looking for, which is this:

- The Future VSTOXX did not prevent the portfolio from rising in 2019 when the Future FESX was bullish.

- The Future VSTOXX had the effect of significantly reducing portfolio volatility throughout the period.

- The Future VSTOXX strongly mitigated the large drop in March 2020.

- The final result is about EUR 1800 better than the Future FESX taken alone.

The Future VSTOXX has the effect of an insurance against market downturns. It's great! But, how much does it cost? Well, it costs a commission per month for the purchase of the chosen number of Future VSTOXX.

Offensive day trading strategy with the Future VSTOXX

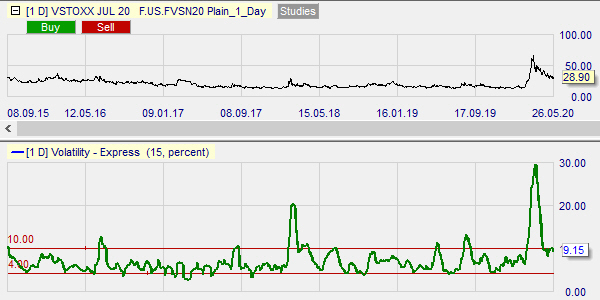

As we have seen in the previous section, the Future VSTOXX is capable of increasing its value considerably when markets fall sharply, as in the case of the Covid crash. But, how did it behave in the period prior to this crash? The answer is given below. In the main chart, we see the daily closing price of the VSTOXX Future since January 5, 2015 and in the sub chart, the average daily volatility of the VSTOXX Future over 15 days.

This information is very interesting because it reveals several trading opportunities:

- Cases where the average daily volatility at 15 days exceeded 10% are very rare, in the order of 6 times in 5.5 years. In these rare cases, there is clearly a huge advantage in knowing the Future VSTOXX and being well prepared to implement the "mega-trade short" which can make us surf the wave of declining volatility, from its extreme levels to those considered normal.

- The average daily volatility at 15 days is never less than 3%! Remember that the Dax or the Dow Jones are indices whose average volatility during this period was between 1% and 2%. The Future VSTOXX is in itself an extremely volatile financial instrument and can therefore be considered as a candidate for day trading.

- The average daily volatility at 15 days rarely exceeds 10%. It is even oscillating between 4% and 10% almost all the time (see red lines). These phases open up opportunities for swing trading strategies based on long entries when the Future VSTOXX trades around 4-6% and short entries when the Future VSTOXX trades around 8-10%. However, these volatile phases, which are not extreme, predominant in the long term and characterized by a volatility swing, can also be exploited with simple trend monitoring strategies as we will see in the following example.

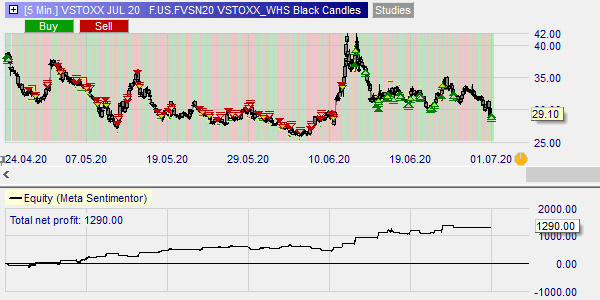

One of my favourite strategies for dealing with a trending market is the Black Candles strategy. In the following example, we choose the period from April 24, 2020 to June 30, 2020 during which the Future VSTOXX is mainly trending downward despite some bullish rebounds. We apply the Black Candles strategy in a 5-min chart with an aggregation factor of 4 and an hourly period between 3pm and 6pm. In addition, we have a trend filter consisting of the SuperTrend indicator in a daily chart. The result is quite interesting and sobering ...

Conclusion

The Future VSTOXX is a financial instrument offered by the Eurex derivative exchange which offers many advantages for investors and which deserves to be inserted in a greater number of trading strategies. These two great advantages are its ability to provide effective and cheap protection for portfolios invested in equities and its own high volatility which makes it a financial instrument that is perfectly suited to be dealt with by classic trend monitoring strategies such as the Black Candles strategy.