Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

What strategy for day trading the Nasdaq?

This is a serious question to which I answer without hesitation "the Black Candle strategy!". This strategy indeed offers very efficient rebound signals and a position management that favours the capture of big moves. In the current context of a bullish Nasdaq, days of big rises are not uncommon, so it would be foolish not to take advantage of them. To maximize our chances of success, the strategy will therefore have to be adapted to the current environment and encourage us to trade in the direction of the trend.

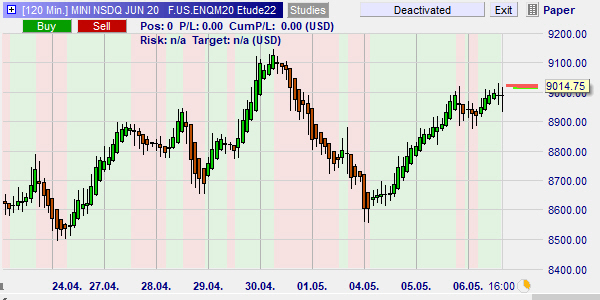

I therefore propose a strategy consisting of two studies. The first study will define the trend to be followed and the second study will open positions using Black Candle signals. I like to use serious tools that accomplish the missions they are given. Also, my first study is a 120-minute aggregation chart in which I put the Heikin Ashi indicator, an extremely effective trend indicator, as one can see below.

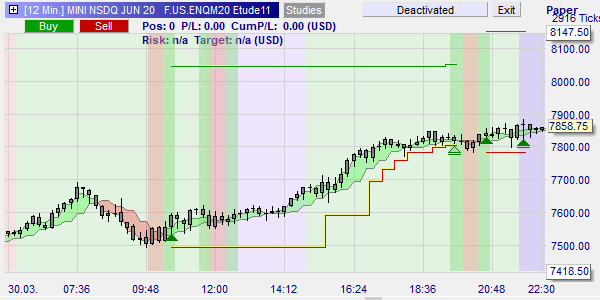

The second study is a 12-minute aggregation chart in which I load the Black Candle strategy and a flat filter. A quick back-test shows us that trends in Nasdaq future often start in the morning. Consequently, we choose the intervals 9:00 - 12:00 and 15:00 - 21:50 which cover the European and American markets. Below a long trade was initiated around 10h30 and closed out in the evening by the trailing stop after a nice rise.

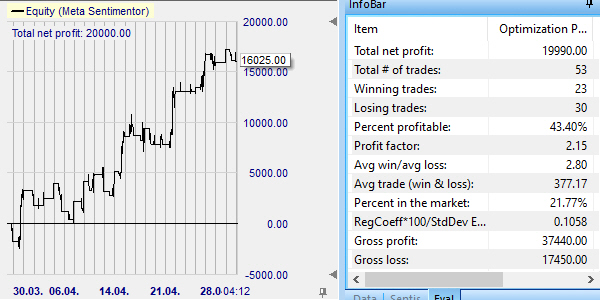

As can be seen below, this strategy has been working well since the beginning of April with a success rate of 43.4% and a gain on loss ratio of 2.8. It is clearly an interesting strategy that can be easily modified and adapted to fit each trader’s choice.

In conclusion, the Black Candle strategy offers many advantages:

- it is easy to implement,

- it has effective signals, and

- its stop and objective have the ability to capture big moves.

In short, a good strategy for traders looking for an efficient approach.