Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Corrections trader Carsten Umland

Carsten Umland studied business administration. He has been trading futures and stocks for his own account for over 12 years. His trading style is based on the concept of Markttechnik combined with every lesson he learned whilst trading his own account for over a decade. His book "Learning how to trade: the perfect entry." was published in 2014.

Carsten Umland is known for his pragmatic approach and clear philosophy. Trading is not a road to riches, trading allows you to buy time. Time is the most precious commodity. Trading allows a person to make the equivalent of his current annual income, but in working less hours a day. The time he saves by converting to trading as a profession, allows Carsten Umland to live on the island of Mallorca and to prepare and compete in numerous triathlons.

| Available (for free) from Carsten Umland in the NanoTrader trading platform. |

| Trading strategies and signals: |

| No |

| Trading Tools: |

| No |

| Videos: |

| Yes (German language only) |

| Trading store: |

| The moving bars and reversal bars strategy |

Improve your trading experience... test a free real-time demo of the NanoTrader trading platform

1. THE MOVING BARS AND REVERSAL BARS STRATEGY

Trend following strategies are considered to be amongst the most profitable strategies in trading. The results of such strategies depend on identifying the trend and identifying the logic entry point correctly. This is where the Reversal bar and the Moving bar come into play. These bars allow traders to find logic entry points during moments when the trend is temporarily interrupted but is likely to 'correct' back to the main trend. This is called a trend correction. The entry points based on the Reversal and Moving bars allow the trader to open positions with an excellent Return/Risk factor.

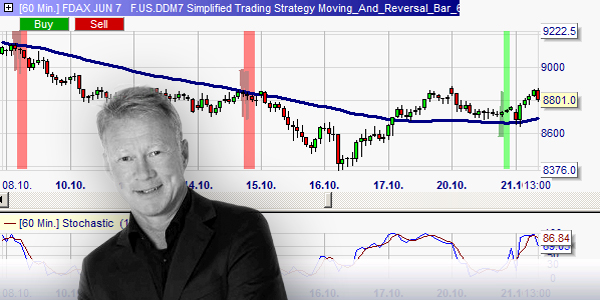

This example shows an instrument in a bearish trend. The bearish trend is temporarily interrupted. A moving bar as designed by Carsten Umland, has appeared because the strategy considers the trend will 'correct' back to bearish.

The strategy can be used for day trading in intraday timeframes such as 5', 15' and 60'. It is also possible to use higher timeframes in which case positions need to be kept overnight. The moving and reversal bars were originally developed for trading stocks overnight but they can be applied to all other instruments including forex and futures.

2. THE CARSTEN UMLAND TRADING PACKAGE

The strategy package is for the NanoTrader trading platform and consists of the following items:

- A pre-configured screen lay-out consisting of three charts in different timeframes. These charts analyse the market and are used for trading.

- The Reversal bar and the Moving bar. They are the basis of the trading signals. The Reversal bars, which are marked green in the charts, give buy signals. The Moving bars, which are marked red in the charts, give short sell signals.

- A unique stop to protect open positions. The stop is determined in such a way that the trades start with a good Return/Risk ratio.

The package actively warns the user when a signal occurs. The user can choose one alarm (e-mail, sound, pop-up) or a combination of alarms.

Carsten Umland comments on the NanoTrader trading platform:

Over to you... test a free NanoTrader demo.