Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Trading from the chart with Charttrader

With the "Charttrader" tool in the NanoTrader platform, the trader can trade directly from the chart. This feature is particularly popular with futures traders or with traders who like simplify things and want to enter and exit the market with a single click.

The advantages of the Charttrader:

- Allows the trader to place an order with one click

- Bracket orders can be created in combination with Tradeguard

- Allows the trader to place OCO (order cancels order) orders

- Delete trades with one click

Activating the Charttrader

First the trader should activate one-click trading. This is done by clicking on the button with the hand symbol in the upper right corner of NanoTrader. This deactivates the confirmation dialog to place orders. From now on, the trader enters the market with one click.

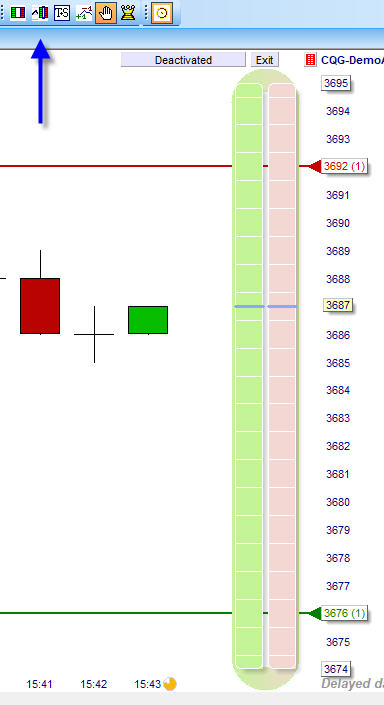

The Charttrader is activated by a single click on the Charttrader icon in the upper right corner of NanoTrader. The tool will immediately be visible in the chart on the right. It has a left column (green) which is responsible for buy orders. The red column (right) is used to place sell orders. With a left click the trader can place a limit order (below the current market price). With a left click above the current market price he activates a market order. With a right click he can activate a stop order. A market order is also possible. Orders can be placed with great precision thanks to the Charttrader.

Stop-Loss Order and Take-Profit Order (Limit Order)

With the "Tradeguard" (top right of the chart) the trader can secure his position with a stop loss order. The Tradeguard also automatically installs a limit order that can be placed by the trader on the price target. In the example above, the trader opened a short position on FESX at a price of 3690. The Tradeguard hedged the trade with a stop loss at a price of 3701 points (red in the upper right corner of the chart trader). At the same time, a limit order at a price of 3679 became active, which served as a profit target (bottom right of the Charttrader, in green). Of course the trader can change his instructions for these parameters at any time.

Close positions and working orders with one click

Current positions and working orders can be closed by the trader at any time, if necessary. To do this, a single click on the grey "Exit" button in the top right corner of the chart is sufficient.

Precise trading with the Tactic-Buttons

An interesting instrument for the futures trader are the Tactic-Buttons (on the right in the picture, in blue). These buttons allow the trader to increase or decrease the level of existing orders by one tick at will. This allows for extremely precise management of positions and orders when the market situation requires it. With one click, the trader can move a stop order by one tick. He can also turn a simple stop order into a trailing stop. He can set the stop to Bid -1. If the market comes back by a tick, the order will be executed immediately.

The trader also has the possibility to add stop types as "Tactic" from the list of "intelligent stops" if he wishes. Thus he "transforms" the fixed stop into an intelligent stop type, such as a Kase-dev stop or a parabolic stop. Using the designer bar he can configure the stops as he wishes.

The tactic buttons also become active for a possible limit order above the market price when the trader adds them. If the trader moves the fixed stop, he immediately deactivates the tactic buttons. He must then activate them again manually.