Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Interpreting technical analysis indicators ... differently

Technical analysis indicators tend to have a 'standard' interpretation. Most traders simply work with this standard interpretation. As a matter of fact, most trading platforms don't even allow traders to interpret indicators in a non-standard way. But what if you think it should be interpreted differently? Or what if your trading strategy idea requires a non-standard interpretation? NanoTrader allows traders to interpret technical analysis indicators any way they want.

The advantages of being able to change the interpretation of an indicator in NanoTrader are:

- You can test any trading strategy as you have imagined it.

- You can verify if a non-standard interpretation yields better results.

- You can save your interpretation as a template.

- You can have different interpretations for the same indicator in different strategies.

- You are free to trade the way you want.

Download a free real-time demo of the NanoTrader Full

1. AUTOMATED INTERPRETATION

When you trade manually you can interpret an indicator any way you want. This is OK for slow trading strategies based on one or two indicators and without signals filters. Once you go beyond this point, technical analysis indicators need to be interpreted instantaneously and automatically by the trading platform. This is where NanoTrader excels.

2. EXAMPLE: THE BOLLINGER BANDS

This example shows the standard interpretation of Bollinger Bands. A long position is bought when a candle closes above the upper band. A short position is sold when a candle closes below the lower band.

Test the free real-time NanoTrader demo

But what other interpretation is possible besides this standard interpretation? The schematic diagram in the screenshot details the 7 key points of this indicator, which you can interpret the way you want. For example, when one observes the Bollinger Bands one can see that the market bounces between the bands. So it is no fantasy to assume that when a candle crosses or touches the upper band, it can reverse back and cross below the lower band.

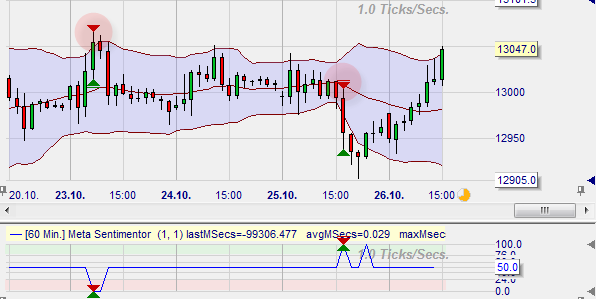

We will set the interpretation up in such a way that when a candle closes above the upper band, a short sell position is opened and vice versa. Additionally, we instruct the NanoTrader to close our position automatically when the price reaches and crosses over the opposite band.

This example shows a profitable short sell trade based on a non-standard interpretation of the Bollinger Bands. The position was opened automatically when the market closed above the upper band. The position was closed automatically when the market price closed below the lower band.