Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

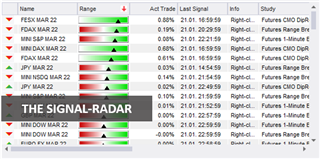

Trading with the SignalRadar

SignalRadar is one of the most innovative trading tools on the NanoTrader platform. The main purpose of SignalRadar is to help the trader identify the most profitable trading strategies and general market trends in real time. As these strategies show the entry price and stop loss and profit targets, a trader can enter the profitable trades, i.e. those that are approaching the profit targets.

Advantages of NanoTrader SignalRadar:

- It displays real-time trades, including the profits and losses incurred until then

- These trades can be displayed in tables or price charts

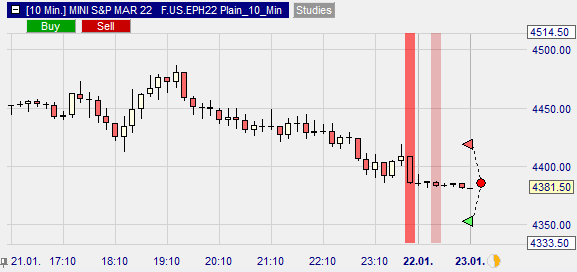

- In the price chart, SignalRadar automatically marks the entry candle green for long trades and red for short trades

- It helps amateur traders to benefit from the trading strategies of experienced traders

- Several tables can be customized according to one's preferences

- SignalRadar helps remove the guesswork and gut-strategies from trading - traders follow only established market trends

How does the SignalRadar work?

In the SignalRadar table you can view the currently available signals according to their profitability. In this case, you order these signals from the most profitable to the least profitable or from the least profitable to the most profitable. The table shows when the trade was opened, its direction, entry price, stop price and price target.

The Range column shows how close the asset's current price is to either the stop price or the profit target.

The "Study" column shows the different trading strategies used to open a particular position. This is very useful when you need to decide whether to buy or sell short a certain asset.

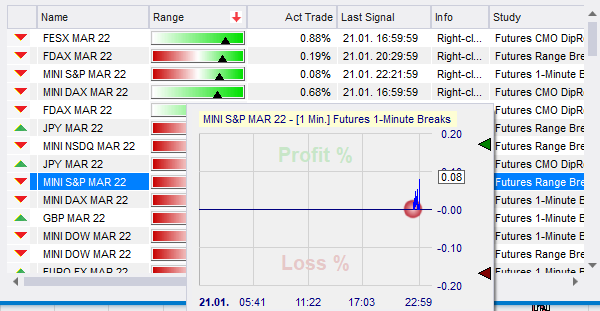

When you hover the mouse cursor over a particular signal, a live price chart for that asset will appear. This chart shows the entry, the current percentage change, the profit target and the stop level.

For example, in the case of the MINI S&P Futures (see chart here below), the current profit is 0.08%. The profit target is about 0.18% above the entry price, while the stop price is 0.18% below the entry price.

You can also display the information shown in this mini-chart in the main chart.

How to identify the best trades

SignalRadar offers a few methods to select the best trades to enter

1. Choose the most profitable trades

The whole purpose of SignalRadar is to populate the live trades opened with different strategies. For example, let's assume that for a certain asset there are more long trades than shot trades with different strategies and that they are profitable. In this case, you should consider going long on this particular asset as well.

Take into account the current yields

Here, neither the trading strategy used nor the current market price is taken into account. You only consider the current profitability of the trade. In the "Current Trade" column, you can sort all trades by their ascending or descending profitability. Next, you select the most profitable trade - but one that is not yet so close to the profit target.

If you move the mouse cursor over the "Range" column, you can see how the price has moved since the trade was opened. You can enter the trade when it is moving steadily towards the profit target.

Conclusion

SignalRadar is one of the most consistent trading tools on the NanoTrader platform. It offers both beginners and experienced traders the opportunity to copy the most popular and profitable trades.