Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Hedging positions, divided opinions

Both NanoTrader Free and NanoTrader Full offers hedging of CFD and forex positions. Hedging means that the trader can have a long and a short position at the same time on the same instrument. These long and short positions can be the same size or a different size.

The TradeGuard function in the platform allows traders to manage open positions. A classic way to manage an open position is by using bracket orders: a profit target (sell limit order) above the position and a stop (sell stop order) below the position. As you will discover the NanoTrader platform is capable of managing both hedging and bracket orders on hedged positions.

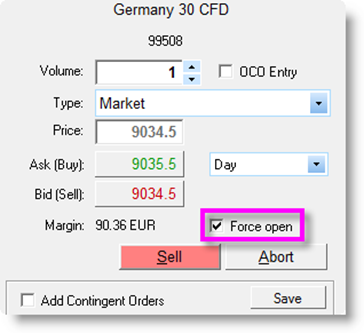

1. OPENING A HEDGED POSITION

A trader with a long position of 1 DAX CFD must be both capable of placing a sell order to close the position or to place a sell order to open a hedged position. To indicate that an order is intended to create a hedged position, the trader selects “Force open” in the order ticket.

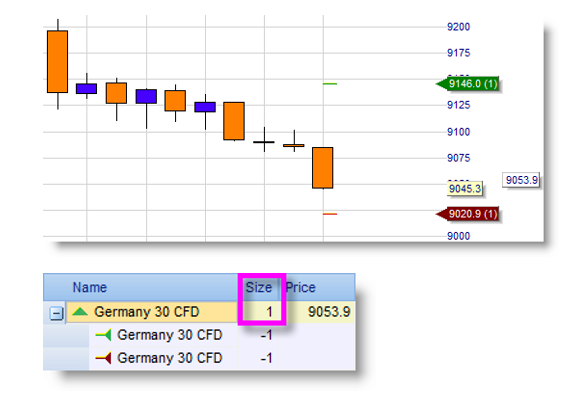

2. FULLY HEDGED POSITIONS

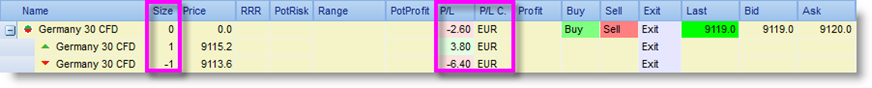

When the long and the short positions are the same size the investor is said to be fully hedged. His combined P&L (profit or loss) will no longer evolve. The loses on the short position is counter-balnced by the profit on the long position or vice versa.

In this example the investor is fully hedged. Being long 1 DAX CFD and short 1 DAX CFD his combined position is flat (0). The combined P&L is -2,60 € (= 3,80 - 6,40). The combined P&L will remain static unless the trader changes the size of the positions or if there is a change in the spread.

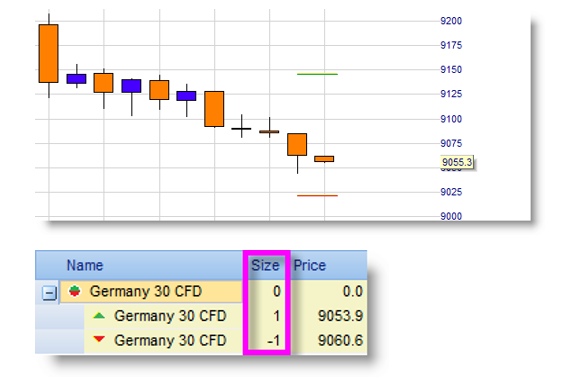

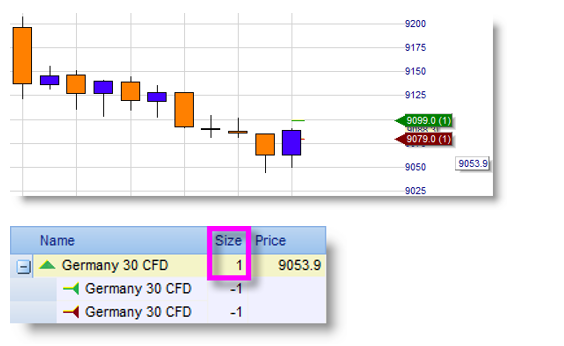

3. HEDGING AND TRADEGUARD

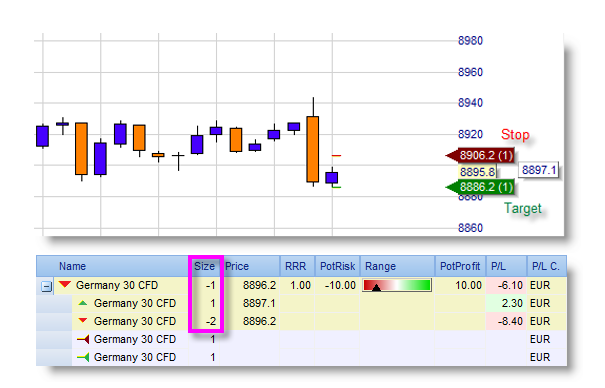

Let’s now also take a look at the bracket orders related to hedged positions. In this example the investor has a long position of 1 DAX CFD. Using the TradeGuard he placed a target and stop around his position. The orders are both visible in the chart and in the account.

The trader now sells 1 DAX CFD. He selects “Force open” in the order ticket. The trader is now fully hedged with 1 long and 1 short position on the same instrument. The TradeGuard has, logically, removed the existing bracket orders on the initial long position:

The trader now closes the short position (e.g. by clicking Exit behind it), effectively removing the hedge. Given that the trader is again at risk, the TradeGuard places bracket orders. Tip: it is possible to grab these orders and slide them to another price level.

4. PARTIALLY HEDGED POSITIONS

A position is said to be only partially hedged when the long position and the short position do not have the same size. The P&L of the combined net position will still evolve. Let’s look at a few partially hedged positions including how the TradeGuard manages the bracket orders. Note that examples below do not follow a strategy or even make economic sense, they solely serve to illustrate the concept of hedging.

In this example the trader is not yet (partially) hedged. He has a long position (+1 DAX CFD) and used the automatic TradeGuard to protect his position with a target and a stop.

The trader now sells -2 DAX CFD and selects “Force open”. The combined net position is thus -1 DAX CFD (= +1 - 2). Notice that the TradeGuard changed the target and stop orders to correctly cover the risk of what is now effectively a short position (-1).

In this example the trader is not yet (partially) hedged. He has a long position (+3 DAX CFD) and used the automatic TradeGuard to protect his position with a target and a stop.

The trader now sells -1 DAX CFD and selects “Force open”. The combined net position is thus +2 DAX CFD (= +3 - 1). Notice that the TradeGuard adapted the target and stop orders by reducing their size from 3 to 2, to correctly cover the risk of the 2 long position.

Download a FREE NanoTrader demo

Deutsches Kundeninstitut (German Clients Institute) broker comparison:

"It gives me great pleasure to inform you that WH SelfInvest scores 5 out of 5 stars with the BEST possible mention , "extremely good" (1,3). This makes you de best CFD-Broker for 2018. Congratulations!"

These are the scores of WH SelfInvest in the sub-categories:

- Order execution: 5 out of 5 stars. Mention: very good (1,2).

- Trading platform: 5 out of 5 stars. Mention: very good (1,1).

- Mobile trading: 5 out of 5 stars. Mention: very good (1,1).

- Customer service: 5 out of 5 stars. Mention: very good (1,4).

Test a free real-time Demo of the NanoTrader Full trading platform.