Test NanoTrader Full I Test Tradingview I Test the mobile platforms All for CFD-Forex & Futures

You are here

Market wizard Linda Raschke

Linda Raschke began her career as a market maker in 1981. She has been registered as a CTA since 1992. In 2002 she founded and managed her own hedge fund, which was so successful that Jack Schwager interviewed her for his book "Market wizards". Linda stands for performance, durability and consistency.

Related to Linda Raschke and available free of charge in the NanoTrader (FREE demo) trading platform:

1. Trading strategies, signals and tools

The Momentum Pinball strategy (with trader Larry Connors)

The Turtle Soup strategy

The Elliot Oscillator

2. SignalRadar (more)

Yes

Trader Linda Raschke

The Elliot Oscillator

The Elliot Oscillator is calculated from the difference between two simple weighted moving averages (SMAs). To do this, the values of the shorter average (SMA3) are subtracted from those of the longer one (SMA10). The result is displayed as a histogram above and below the zero line in the subwindow of the chart. The result is smoothed by a simple 16-period weighted average. This indicator is very similar to the MACD indicator. It can be used in any time frame (intraday, day...).

The oscillator, made popular by Linda Bradford Raschke, identifies the momentum of market movements and highlights new momentum highs and lows.

A distinctive feature of the Elliot Oscillator is that it looks for new momentum highs/lows in the oscillator that coincide with new highs/lows as in the market price. When a new high/low occurs in both the oscillator (in the last 20 periods) and the price (in the last 40 periods), the NanoTrader changes the background of the indicator to blue.

Recommended broker

Linda Raschke's trading strategies

The Momentum Pinball strategy

The Momentum Pinball Strategy was developed by traders Linda Raschke and Larry Connors. It is a range break-out strategy. Positions are held for 1-2 days. Linda Raschke and Larry Connors claim

"For... 1-2 day setbacks, the Momentum Pinball Strategy is unbeatable".

The pinball indicator, which got its name because it jumps back and forth between two trigger levels, informs the trader whether there is a buy or sell signal for the next day. If the market breaks out of a certain range on the following day, a position is opened in the direction of the signal.

Free demo including this strategy

The Turtle Soup strategy

The name of the strategy is a reference to the widely known Turtle Trading Strategy. In the 1980s, this strategy was taught by Richard Dennis and William Eckhardt to a group of novice traders called the Turtles. Linda Bradford-Raschke reversed the reasoning behind their strategy, with the aim of developing a short-term trading strategy.

The Turtle strategy developed by Dennis and Eckhardt is a trend-following strategy. Trend following strategies usually have a small percentage of winning trades (< 50%, usually around 40%). The amount of profits are not only sufficient to compensate for the losses, but to exceed them.

Due to the fact that trend following strategies have only a small percentage of winning trades, they must by definition have a large number of false breakout signals and short-term reversals. Linda Bradford-Raschke wanted to develop a strategy that would profit from just such false breakouts and short-term reversals. In her view, this would lead to a strategy with a high success rate. The result was the Turtle Soup Strategy, which in effect is a reverse Turtle Strategy.

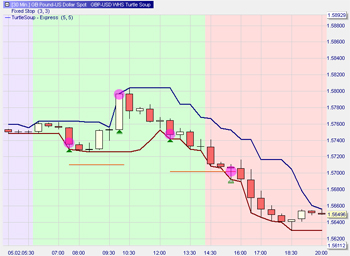

The Turtle Soup strategy is used for forex pairs in the 30-minute chart.

This example shows two buy signals. The buy signals are accepted because (1) the signals filter is positive (green background) and (2) the signals appear within the 06h00-22h00 time interval. The signals are 5-period lows. The first long position is closed with a profit when the first 5-period high appears. The second long position hits the fixed stop (red line) and is closed with a loss.

Free demo including this strategy

The results on the EUR/USD and the EUR/GBP forex pairs.

People also read

Larry Connors, trader and entrepreneur

Assembling a forex trading strategy (e.g. Babypips)

Recommended regulated managed account service